One of the by-products of the credit crunch has been the rise in shadow inventory. Within my own market stats, I consider shadow inventory all units that are complete or under construction but not yet offered for sale as condos (sometimes as cond-ops or co-ops). In many cases the developer was unable to sell the initial block of units offered and is therefore unable to release the units behind them.

The development stalls because the lender behind the developer usually prevents the units to be converted to rentals because the value of the project would fall considerably as a rental on their balance sheet, causing stress to their capitalization ratio.

The lender’s reluctance to make such a decision is referred to as:

* pretend and extend

* pray and delay

* kick the can down the road

* a rolling loan gathers no loss

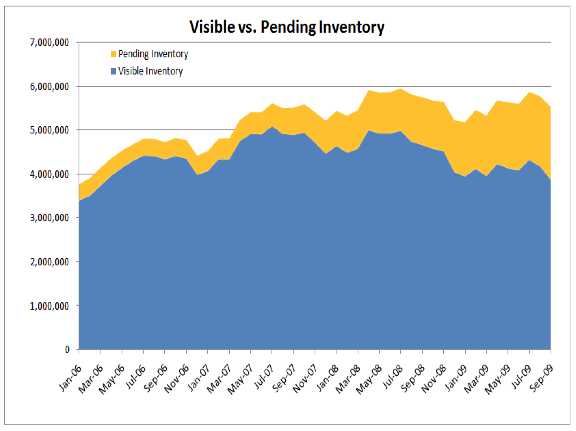

First American CoreLogic tracks shadow inventory. They define shadow inventory as real estate owned (REO) by banks and mortgage companies, as a result of foreclosures and other actions, such as deeds in lieu, as well as real estate that is at least 90 days delinquent. They put the amount of shadow inventory at $1.7M in 3Q 09, up 54.5% from $1.1M a year ago.

Visible inventory, like the amount estimated NAR and Census every month, is estimated at $3.8M, down 19.1% from $4.7M last year.

>The total unsold inventory (which combines the visible and pending supply) was 5.5 million units in September 2009, down from 5.7 million a year ago. The total months’ supply was 11.1 months, down from 12.7 a year earlier. This indicates that while the visible months’ supply has decreased and is beginning to approach more normal levels, adding in the pending supply reveals there is still quite a bit of inventory that will impact the housing market for the next few years, especially in the context of the current increase in home sales, which is in part due to artificially low interest rates and the homebuyer tax credit.

In other words, even with the surge in activity over the past several months, total inventory hasn’t changed all that much (I agree with Bob).

3 Comments

Comments are closed.

The drop although modest in “all inventory” is encouraging but the “shadow” looms. If the total unsold inventory hasn’t changed much are we just running in place? And what happens when interest rates rise, (they will) first time buyers credit expires, (it will) does the “shadow” overtake us?

NAR recent report on pre owned sales increase and inventory decrease is encouraging, but I do believe analysis above is much more accurate. Tax credit seemed to be the fuel for recent home sales. It would be more encouraging if sales data revealed a steady increase without assistance from programs and short term drivers that have artificially influenced a short term gain. I agree with Bob as well…inventory hasn’t changed all that much.

How did you find unsold REO properties? That would be tough to isolate where I am, it is a well kept secret.

Did discover a twist on the game here. A developer has a nice little subdivision with quasi-custom homes. He is peddling the NAHB myth that appraisers are keeping values low and in order to keep his subdivision free (he believes) from the market depressing influence of foreclosure or extended DOM, does rent to own on 10% of the built out and plays like they are sold. He is pursuing the myth that foreclosure and tight lending has effected only isolated pockets of the community.