After all the housing news drama of the past month, I thought it was interesting to see the negative streak broken. Still, sales are below year ago levels after what I described as a “release of pent-up demand” that was caused by the expiration of the “fiscal cliff” and the looming rise in mortgage rates last year.

Although home sales are expected to trend up over the course of the year and into 2015, this year began on a weak note and total sales are unlikely to match the 2013 level.

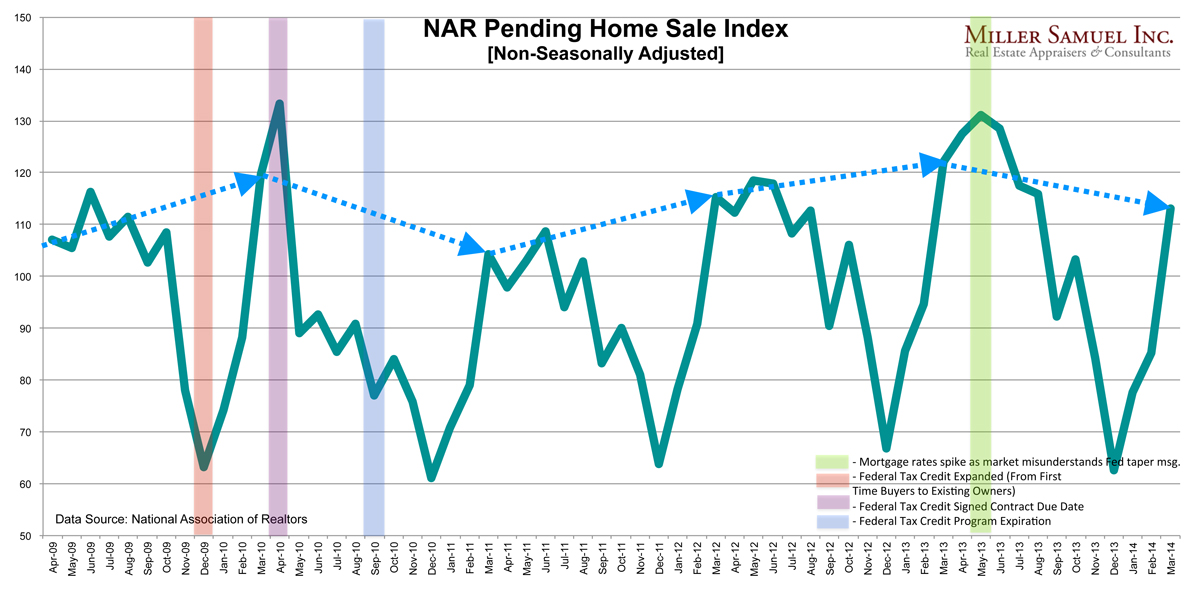

All the indices NAR publishes bother me because they include seasonal adjustments and those adjustments can be very severe. The chart above has no seasonal adjustments so you can see how much adjusting has to take place to smooth out the line. I thought I’d take a look at the month-over-month data that wasn’t seasonally adjusted to see if the same pattern occurred.

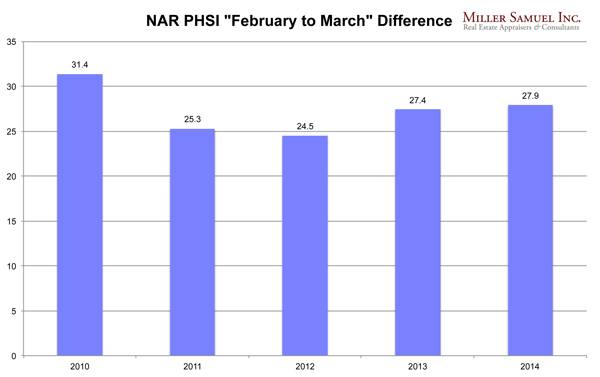

Yes, month-over-month pending sales rose the most since 2010 when the market was wildly skewed (higher) as a result of the First-Time Homebuyer Credit (federal first time buyer and homeowner tax credit).

February to March 2014 had the largest increase in contracts than the same period in each year since 2010.

One Comment

Comments are closed.

[…] weak NAR Existing Home Sales report has unleashed a surge of housing self-loathing (although today’s PHSI seems to take some of the drama/edge […]