Actually, overall Manhattan Home Sales are 45% All-Cash. I want to make sure that the 80% number doesn’t become embedded in our housing market mindset.

________________________________________________

I’ll explain.

Recently a friend passed along a post in the Washington Post titled: 8 in 10 Manhattan home sales are all-cash and my jaw dropped. The author, who I am a fan of, got this information from Realtytrac, who I am also a fan of, but I knew it was either wrong or misinterpreted.

Over the years I’ve played around with NYC mortgage data, usually incomplete and very dirty, from various sources and have combined that with frontline feedback from our own experience as appraisers, as well as from real estate brokers and lenders. I had come to the conclusion that roughly half of Manhattan home sales (co-op, condo & single family) were probably all-cash and condos are definitely well over 50%. I used the logic that foreign and high-end buyers are a large part of the all-cash market, especially within the new development space. And it makes sense – while condo end loan financing is tight, new development condo end loan financing is beyond tight.

The reason the Realtytrac 80% figure jumped out at me was the fact that co-ops account for about 60% of sales and have the highest concentration of entry level and middle class demographics in Manhattan. I was very skeptical that virtually all the market-majority co-op buyers were paying all-cash, especially in the tepid economy we are stuck with.

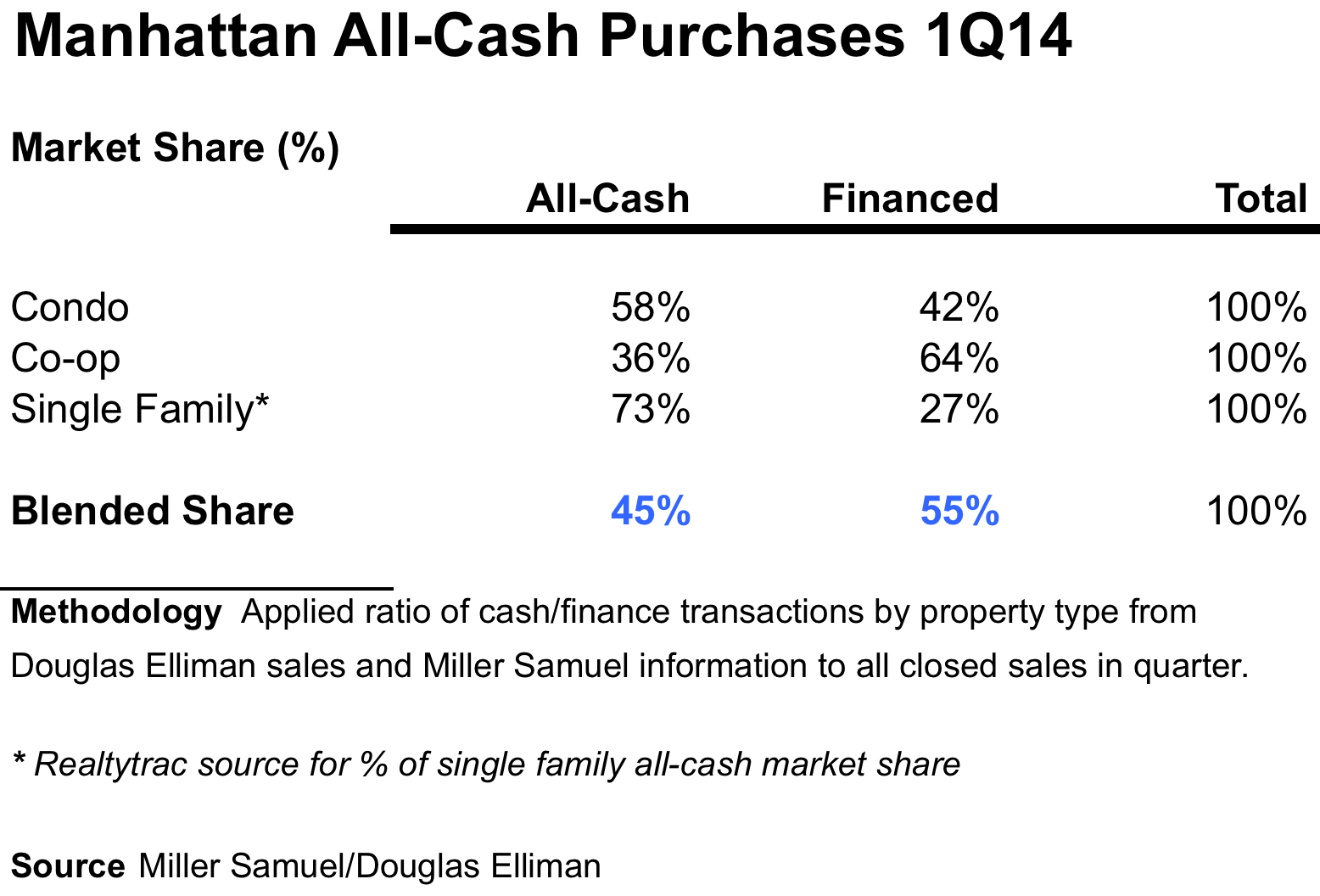

So I reached out to Daren Blomquist, Vice President at RealtyTrac who is often the point person on their data releases. I indicated that the 80% figure seemed off and wondered if it excluded the co-op market. It didn’t. However even an 80% all-cash share for only single family and condo sales seemed like a stretch. He said he would look into it and within an hour they could see an issue with their co-op data feed. They were already working on the issue (and why I like Realtytrac). He shared their 1Q14 Manhattan information (I omitted the suspect co-op data) and here are the key numbers:

Their Results

All-Cash Condo Sales 60.78%

All-Cash Single Family Sales 73.08%

I came up with a new methodology, which looked at the ratios seen in Douglas Elliman sales – the largest real estate brokerage company in Manhattan – with a sales mix is generally consistent with the overall market mix and applied their results to the overall market, and I saw this:

Our Results

All-Cash Co-ops 36% (no revised Realtytrac results yet)

All-Cash Condos 58% (similar to Realtytrac’s 60.78%)

I didn’t have the single family (fee simple) results compiled so I went with Realtytrac’s 73% because: their fee simple (condo) data was consistent with ours, the single family market is skewed much higher price-wise than the condo market (i.e. skewing towards cash buyers) and the single family market share is very small. In fact the market share is so small that the overall 45% all-cash ratio wouldn’t change unless I dropped the single family market share down to 6% from 73% but even then the overall cash ratio would only drop to 44% from 45% – so you get my point (my apologies for the excessive wonkiness on this but it was necessary).

As a result and represented in the table at the top of this post, it is reasonable to say that the overall Manhattan all-cash home sale market in 1Q 2014 was 45% of all residential sales. Got it?

4 Comments

Comments are closed.

[…] • • • Manhattan Home Sales Are NOT 80% All-Cash (They Are 45%) (Miller Samuel) • Two Housing Markets for the Two Americas (Fiscal Times) • How Wall Street recruits so many […]

[…] of sales are all-cash […]

[…] Manhattan Home Sales Are NOT 80% All-Cash (They Are 45%) (Miller Samuel) […]

[…] Miller-Samuel estimates that the all-cash share in Manhattan was 45% in Q1 2014. Not Florida levels, but still “too damned […]