Douglas Elliman published the Manhattan/Brooklyn rental report that I author today. This monthly report is part of an evolving market report series I’ve been writing for Douglas Elliman since 1994. We discontinued the quarterly rental report series but still present the information in our aggregate database.

MANHATTAN

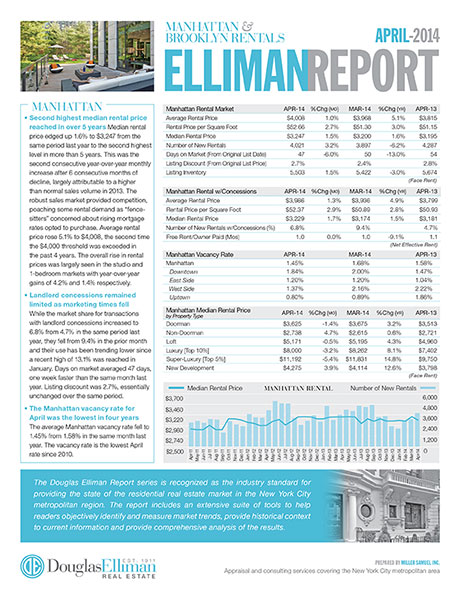

– Second highest median rental price reached in over 5 years (highest was one month spike to $3,695 in Feb-09).

– Second consecutive month with year-over-year rise in median rent after 6 consecutive monthly declines.

– The vacancy rate was the lowest for an April in 4 years, falling to 1.45% from 1.58% a year ago.

– Market share of landlord concessions was up slightly from last year to 6.8%, but down from recent January peak of 13.1%.

– The number of new rentals slipped 6.2%, as landlords and tenants have remained more in sync for the 3rd consecutive month.

BROOKLYN[North, Northwest Regions]

– Median rental price up year-over-year for the 11th consecutive monthly increase.

– New rental activity surged 57.1% as tenants pushed back against rising rents at time of renewal.

– Marketing times and negotiability expanded from a year ago, but remained stable over the past 3 months.

– Studios showed the largest rise in median rental price. 1-bedrooms and 2-bedrooms also increased.

– Brooklyn median rent was $442 less than Manhattan median rent, up from $210 record low in February.

Here’s an excerpt from the report:

MANHATTAN Median rental

price increased 1.6% to $3,247 from the

same period last year to the second highest

level in more than 5 years. This was the

second consecutive year-over-year monthly

increase after 6 consecutive months of

decline, largely attributable to a higher

than normal sales volume in 2013. The

robust sales market provided competition,

poaching some rental demand as “fencesitters”

concerned about rising mortgage

rates opted to purchase. Average rental

price rose 5.1% to $4,008, the second time

the $4,000 threshold was exceeded in

the past 4 years. The overall rise in rental

prices was largely seen in the studio and

1-bedroom markets with year-over-year

gains of 4.2% and 1.4% respectively…BROOKLYN The 11th

consecutive increase, median rental price

increased 3.9% to $2,805 from the same

month last year, but fell 3.3% from the

prior month record of $2,900. Average

rental price followed a similar pattern

rising 6.4% to $3,209 over the same

period. Despite the rising trend, month

over month rental price trends for all

indicators have showed relative stability

since the beginning of the year…

_________________

The Elliman Report: 4-2014 Manhattan/Brooklyn Rentals [Miller Samuel] The Elliman Report: 4-2014 Manhattan/Brooklyn Rentals [Douglas Elliman] Miller Samuel Aggregate Database [Miller Samuel] Chart Gallery (Brooklyn Monthly) [Miller Samuel] Chart Gallery (Manhattan Monthly) [Miller Samuel] Chart Gallery (Manhattan Quarterly) [Miller Samuel]