Real estate reporter Katherine Clark at the New York Daily News got the scoop on the $70,000,000 penthouse sale at 960 Fifth Avenue, the highest price ever paid for a Manhattan co-op apartment. Curbed New York lays out all the (pretty?) pictures.

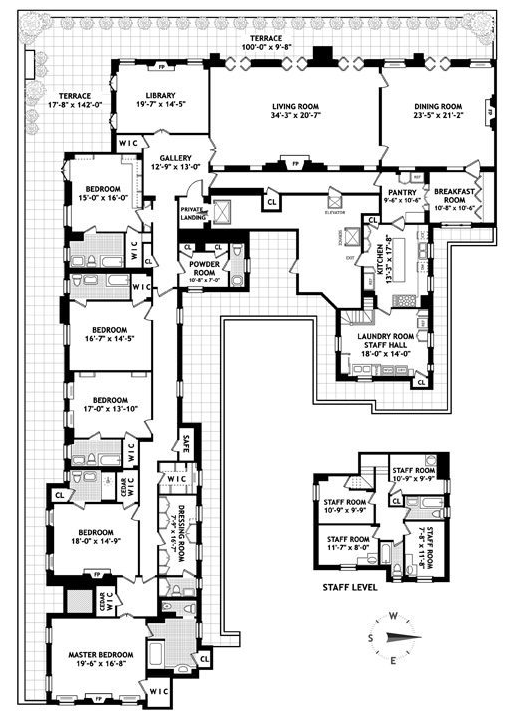

The previous record was held by David Geffen, who paid $54,000,000 in 2012 for the Penthouse at 785 Fifth Avenue. Although the Geffen penthouse was renovated, it was 12,000 square feet, more than twice as large as the 5,500 square feet within the penthouse at 960 Fifth Avenue – that just sold for a record price of $70M.

To further illustrate how much more expensive this new record price actually is, take a look at the two highest Manhattan co-op sales prices achieved, but on a price per square foot basis:

David Geffen paid $4,500 psf for the penthouse at 785 Fifth Avenue for the then record price of $54,000,000.

Nassef Sawiris paid $12,727 psf for the penthouse at 960 Fifth Avenue for the new record price of $70,000,000. On a sales price basis, the new record is 29.6% higher than the old record of 2 years ago.

On a price per square foot basis, the record sale was 182.8% above the previous record sale price set two years ago.

With all the attention focused on the newish or new development residential condo market, the all-time price per square foot apartment record was set 2 years ago, around the time of the Geffen purchase. A Russian oligarch paid $88,000,000 for Sandy Weill’s penthouse condo that works out to $13,049 per square foot. That record breaking sale was largely viewed as a market outlier, that the buyer overpaid as part of a larger divorce strategy – since it was 31% higher than the previous record in the year prior within the same building.

Some other oddities about this new record co-op sale at 960 Fifth Avenue:

– The 960 Fifth Avenue co-op board is old world and I’ve heard it is fairly tough. As a general statement, it is not that common to see a foreign buyer at the high end of the market approved by a co-op board.

– The news coverage suggested the buyer was slow to pay his taxes and negotiated a reduced amount with the government. This would be a concern for most co-op boards in terms of collecting maintenance charges in arrears from a foreign national if they stopped paying.

Since these conditions would probably make any high end co-op board nervous, perhaps this is a sign that shareholders (board members are also shareholders) are concerned about damaging potential property values by limiting the universe of people that would be able to afford these types of prices in this new market condition.

One Comment

Comments are closed.

[…] Default Risk Plummets (Bespoke) • Manhattan Penthouse Co-op Sold For 2nd Highest PPSF in History (Miller Samuel) see also Silicon Valley adds fuel to San Francisco’s red-hot property market. (WSJ) • 5 […]