I really enjoy Bob Schieffer’s Face the Nation program and listen to the podcast on a regular basis. I was particularly interested in the discussion this past week with senators Mitch McConnell and Chuck Schumer, as well as New York Times reporter columnist David Brooks because they discussed the stimulus plan passed by the House of Representatives and now making its way through the Senate.

I was a bit taken aback by the “non-stimulus” earmarks thrown in for good measure but both Senators seem to be interested in the rapid passage of the bill after modifications are made.

However, the main theme in all this and frankly in most political discussions on the economy seems to point to housing as the root of all our problems and therefore lower mortgage rates and tax credits are the answer.

Download the transcript to see what I mean. Housing is not understood.

Perhaps this is semantics, but the housing crisis was not the cause of the problem, it was the straw that broke the camel’s back (that phrase really looks weird in actual text). Home buyers and home owners looking to refinance, won’t be helped much by these solutions.

Because it is all about underwriting.

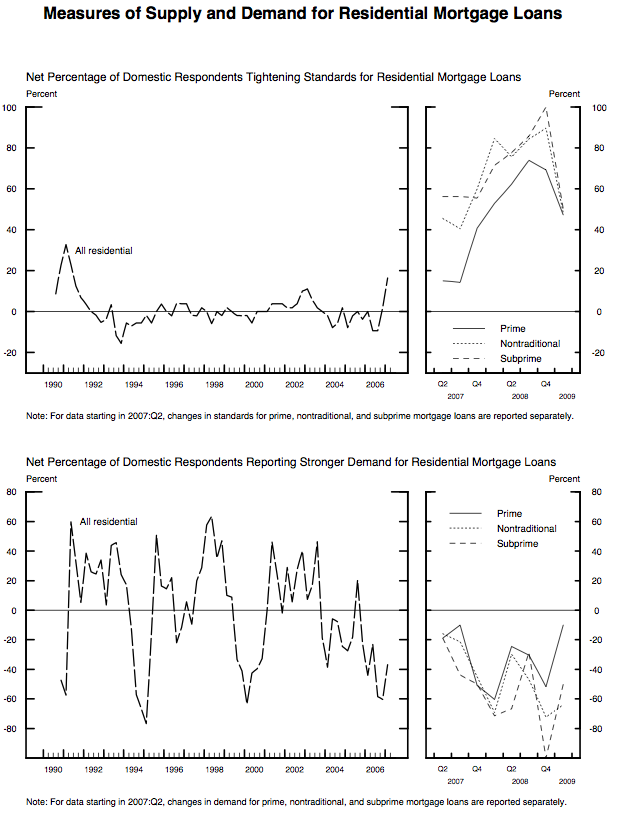

Look at the Fed’s Senior Loan Officer Survey above – underwriting restrictions are up significantly in the past two years.

Think of a bank making the decision to lend right now – applicants have rising jeopardy for job loss and housing markets are declining – future losses loom for lenders as well. Not a comfortable environment for making a loan without very difficult terms. That is what is choking off the housing demand. It’s not because buyers need a bigger tax deduction or need a lower mortgage rate to qualify. They need to qualify for mortgages within reason.

Housing is a lagging indicator not a leading indicator.

Focus on credit and the financial system. And I think we need to let some of the financial institutions fail – as painful as it can be.

>The problem is, with house prices still in free fall and unemployment rising, tight lending standards, as evidenced by the latest survey of Senior Loan Officers, make sense.

>The bigger conundrum for Washington, however, is that, just as the banking sector appears to have suddenly found religion, consumers are also unhelpfully doing the same. Almost half of loan officers surveyed reported weaker demand for consumer loans. Demand for mortgages, while having improved from December’s nadir, remains weak. Meanwhile, demand for commercial and industrial loans has plummeted.

>Unfortunately, this is largely unavoidable. Plunging stock markets and property prices blew a $5.6 trillion hole in households’ net worth in the first nine months of 2008. That surely worsened in the fourth quarter.

Consumers simply don’t have all the money in the world, even if retailers are offering 70% discounts.

4 Comments

Comments are closed.

I have been of the impression that if household income had kept pace with mortgage payments things would have been different. Well, yeah.

But keeping everybody employed with rising wages is a tall order.

I think you may have something here about cause and effect. And it is the same. Lax underwriting brought about an inflated market and tight underwriting brought it down.

I looked for the respondent’s reasons for tightening credit. It basically boils down to the economic outlook and decreased liquidity. The banks don’t think the borrowers will repay loans as the economy weakens and that the secondary market and the banks are not sufficiently liquid to support risk.

So credit has tightened and the prophecy came true. You are right. The residential real estate market, and indeed any market that includes mortgage as a significant component is at the mercy of underwriting.

New York Times reporter David Brooks

No – wrong. Brooks is not a reporter, he’s a columnist. Do not ever assume that anything he writes is based on reporting – it isn’t. It’s the same thing as calling you an housing economist – you’re not, you don’t claim it. He isn’t, he doesn’t claim it, and you’re better than a mistake like that.

I stand corrected corrected, fatbear. It would be like calling me “master of the universe” yet I am just a real estate appraiser. 😉

Yes, but that’s an honorable profession, much more so than being a columnist.