We’ve expanded the Elliman rental report to include Queens this month and added additional metrics for Manhattan and Brooklyn.

MANHATTAN

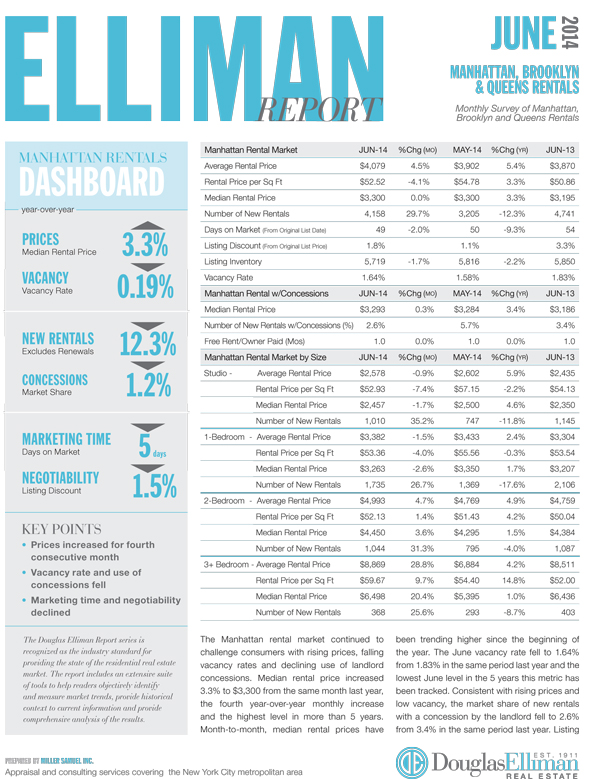

– Prices increased for 4th consecutive month after year end lull.

– Median rent is at highest point in more than 5 years.

– The vacancy rate was lowest June in 5 years.

– Use of concessions continued to fall, now at nominal levels.

– Marketing times and negotiability continued to fall.

– Luxury market outperformed the overall market.

BROOKLYN[North, Northwest, East Regions]

– Median rental price up year over year for 13 consecutive months.

– Rents hovering near record highs but have remained stable since beginning of year.

– New rentals surged indicating resistance to price increases at time of renewal.

– Nominal use of concessions by landlords.

– Overall market outperformed luxury market, price growth stronger in smaller units.

– Manhattan-Brooklyn rental price gap remained at $500, more than the $210 record low in February but less than half of 2008 level.

QUEENS[Northwest Region]

– Median rental price year-over-year slipped after 4 consecutive monthly increases.

– Shift in mix to smaller units (60.2% share of 1-bedrooms) pulling down overall prices.

– Nearly half of the rental stock is located in new development buildings.

– Overall market outperformed luxury market, price growth stronger in smaller units.

– Marketing time slipped as listing discount remained nominal.

_________________

The Elliman Report [Miller Samuel] Miller Samuel Aggregate Database [Miller Samuel] Chart Gallery [Miller Samuel]