There was a good article in the New York Times yesterday: In Many Cities, Rent Is Rising Out of Reach of Middle Class

Many have complained about the Federal Government’s (and our society’s) overselling of homeownership over the past decade and how the decline in homeownership will eventually lead to an emphasis on rentals in the US. Of course, like many housing market ideas, good and bad, they tend to be presented in a vacuum, without real context.

I believe much of this discourse is in reaction to tight credit combined with a weak economy rather than some sort of fundamental cultural and economic shift. During the bubble we got the opposite discourse – that there was a fundamental cultural and economic shift towards homeownership.

Currently there is a much smaller subset of Americans that have access to financing. According to the Federal Reserve Senior Loan Officer Survey, lending has actually tightened in 2014 over 2013 (related to QM). Many homeowners are unable to sell because they can no longer buy and many renters no longer qualify for financing so the idea of of homeownership as a goal fades.

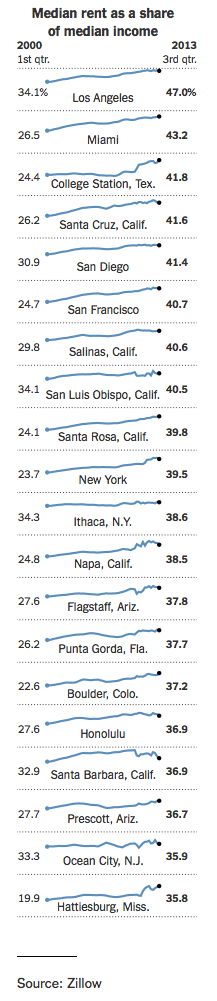

Case in point has been the recent public discourse on the issue of home affordability, whether it be sales or rentals. Zillow presented an analysis for the New York Times that illustrates how much rents have risen in the past 13 years (since 2000) in cities across the US.

Here’s the scenario:

The economy is weak – we are seeing tepid growth in employment, stagnant incomes and historically tight residential mortgage lending.

– Approximately 38% of homeowners can’t buy their next home so they won’t list their home for sale.

– Buyers without credit issues won’t list their homes until they can find something to buy.

– The lack of supply presses prices higher because those who have access to credit have little inventory to choose from, driving up prices.

– Renters looking to buy can’t find a home they want to purchase so they are kept in the rental market.

– Renters looking to buy don’t qualify for a mortgage so they stay in the rental market.

The organic flow out of the rental market into the sales market is slowed and a log jam is created of too many renters and not enough buyers.

Rising rents against stagnant incomes creates an affordability crisis. The sales and rental markets are connected. They are not mutually exclusive.

Rising rents are a product of tight credit, which is a residual byproduct of the financial crisis. Fix the economy and credit eases, then lending normalizes (no, not circa ’06) and the pressure on rental housing is eased.

ASIDE

I’m not entirely confident with the reliability of the historical rental data being presented to the New York Times by Zillow – but I still agree that affordability is being pressured:

– Zillow was launched circa 2006 and rents are not public record so the early data has to be super thin.

– The comparison was made between a first quarter (low) and a third quarter (high) in a highly seasonal market.

– I am not sure if “New York” means Manhattan or New York City. If it is Manhattan, then our median rent figure in 1Q 2000 was $2,600 in nominal terms, and $4,276 in real terms. In nominal (unadjusted for inflation) terms, rents have risen 23.1% through 3Q 2013 while real median rent has fallen 27.3%. The Zillow median rent as share of median income nearly doubled, rising from 23.7% to 39.5%. Either incomes have collapsed in NYC or the 2000 rental figure being punched into their model is flawed, ie way low, no?

Other inights on any of this would be appreciated.

2 Comments

Comments are closed.

Jonathan Miller —

As I previously implied, based on observations of past database and analytical incomprehensability, I personally do not trust any presentations or interpretations

emanating from Zillow (even if I believe in the same conclusions or believe that the conclusions are correct).

If necessary, I would go to the claimed or obvious source material and make

calculations from there.

The real estate housing market will not stay strong until the economy is fixed or at least vibrant again! Unfortunately this huge problem (the economy) is not on the agenda of anyone in government.