Guest Appraiser Columnist:

Jim MacCrate, MAI, CRE, ASA

MacCrate Associates

Appraisal & Valuation Issues Blog

Jim has worn many hats including a Director at PricewaterhouseCoopers in New York City and Chief Appraiser at European American Bank. He is a prolific writer on valuation issues and teaches a number of the real estate appraisal classes through the Appraisal Institute and New York University. I have had the pleasure of taking a number of courses taught by Jim.

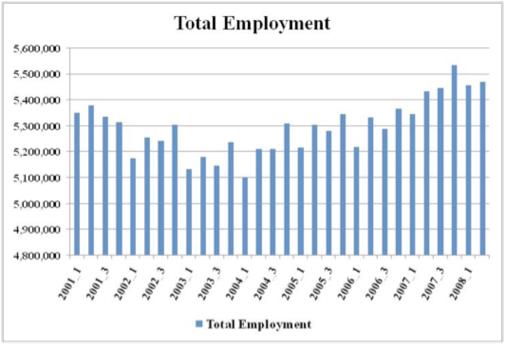

…Jonathan Miller

Many so called real estate experts have been predicting the bottom to the real estate market will occur in late 2009 or early 2010. No one can predict with any degree of accuracy the future, much less the bottom of the real estate market in any metropolitan area. It is important for real estate professionals to remember that real estate markets vary by location. Some markets will do well while others are doing poorly. For example, the Detroit real estate market was depressed long before the recession was declared official by the federal government and the beginning of the decline in the New York real estate market. The real estate market in the New York metropolitan area has been driven low interest rates and by the growth of the financial, insurance, and real estate sectors of the economy which began in earnest in first quarter of 2004 as indicated in the following chart:

Total employment is now falling with the FIRE and construction sectors of economy taking a big hit in employment beginning with the collapse of Lehman Brothers. Real estate salespeople, brokers, and appraisers must stop listening to the noise from Washington, D.C., politicians, and others who have mislead us in the past. What we are witnessing, the economists and politicians have witnessed this before during the late 1920’s, the late 1950’s and early 1970’s. In order to properly value real estate, one must cut out all the outside noise and analyze carefully what the local real estate market data is telling you.

On a Macro Basis the Indicators are all Negative

The recent indicators reported by the government suggest that the economy is improving because the rate of unemployment is declining, consumer confidence is improving, the rate of decline in manufacturing is subsiding, etc. All of the above and other statistics still suggests that economy is not improving and real estate values will not begin to rebound until the economy turns over and employment begins to increase with an increasing payroll income and wealth. That is not bound to happen for awhile.

In the New York Metropolitan area, the leading indicators for increasing real property values are all declining, including the following:

* Population is stabilized or falling

* Number of households has stabilized or is declining

* Total employment is declining

* Total payroll/income is declining

* Consumer confidence is negative

* Businesses are still contracting including manufacturing, retail and the financial services sectors of the economy.

The results of the 2010 Census should be interesting nationwide. Listen to what the leading indicators are telling you about the macro market.

Now, on a Micro Basis

Real estate is fixed and immobile. The value of real property is driven by local indicators which impact the demand for real estate in a specific location. All the macro indicators referred to above are also negative in the New York Metropolitan area. In order to determine if the real estate market is rebounding versus stabilizing at a much lower level of activity and prices, the following factors should be analyzed carefully in addition to the factors that generate demand:

* Sale price trends

* Increase/decrease in the number of sales

* Increase/decrease in the number of listings for sale

* Increase/decrease in the number of days on market

* Increase/decrease in sales concessions

* Response to for sale or for lease advertisements

* Increase/decrease in the number of foreclosures

* Increase/decrease in the number of loan defaults.

These trends are extremely important to watch, but the trends will not reverse until consumer confidence is positive and total payroll/income, employment and the number of households is increasing. It must be remembered that real estate prices remained depressed for several years after the recessions of the 1970’s and 1980’s. Why should this time be any different, and, in fact, it is already worse in many markets.

3 Comments

Comments are closed.

[…] from:Â [Vortex] Straight from MacCrate: When Will Real Estate Prices Stabilize in the New York Metropolitan… […]

[…] [Vortex] Straight from MacCrate: When Will Real Estate Prices Stabilize in the New York Metropolitan… […]

Thanks Jim for recognizing the impact of macro economics on our limited perspectives. “…real estate values will not begin to rebound until the economy turns over and employment begins to increase with an increasing payroll income and wealth.”

I have a suspicion that the employment/income picture is much worse than reported. I am told that protectionism is anathema to economic health, but I think something has to be done with income parity if before we can expect to see a growing economy. Of course that assumes quants won’t be inventing opaque investment vehicles in the near future.