Today I Iistened in to an informative conference call hosted by Trulia’s co-founder and CEO Pete Flint and RealtyTrac‘s Rick Sharga. As always great stuff, and I got to act like a reporter and ask a question – lots of reporters were on the line. More on my question in a later post.

Pete commented that as we go into a housing market of declining government support, foreclosures will continue to become an integral part of the housing market – loan mod programs were not making an impact on foreclosure volume. Rick suggested the “short sale” phenomenon was over hyped because it will not solve the significant foreclosure problem. Foreclosures will peak in 2011 and then return to normal levels by 2013. 5.5M properties in serious delinquncy, 100k new foreclosures per month with a 55 month supply.

Interesting survey results (press release or on Trulia Blog)

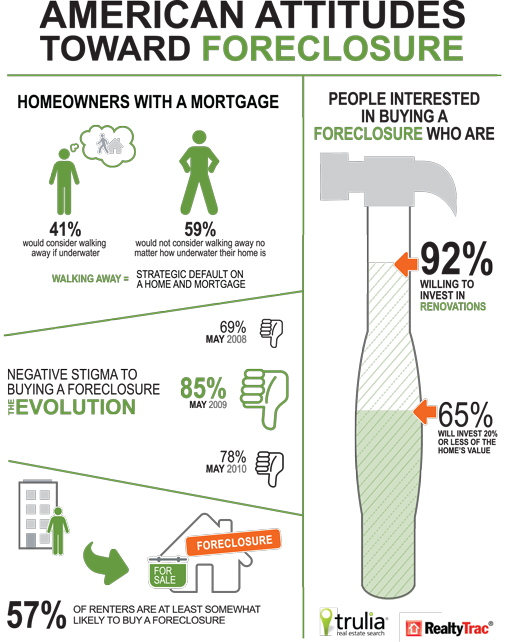

* 59 Percent of homewoners with a mortgage would not consider walking away from their home no matter how much their home is “underwater”.

* 1 Percent of Homeowners With A Mortgage Say Walking Away Is Their First Choice If Unable To Pay; 69 Percent Say Modifying Their Loan is Their First Choice

* While the stigma around owning a foreclosure has subsided, interest in purchasing a foreclosure is significantly down year-over-year

* For every borrower who avoided foreclosure through HAMP last year, another 10 families lost their homes. It now seems clear that government programs will not reach the overwhelming majority of homeowners in trouble

* 18 percent of U.S. adults expect bank-owned homes to offer a realistic price discount of less than 25 percent off the value of a similar home that was not in foreclosure

* 36 percent saying that they expect to receive a discount of 50 percent or more when purchasing a bank-owned property

* 78 percent of U.S. adults believing there are downsides to buying foreclosed properties compared to 85 percent in May 2009

* The majority of U.S. adults (92 percent) said they would be willing to invest in improvements such as renovations and remodeling if they purchased a foreclosed home

* Renters are showing strong interest in buying foreclosed properties, with 57 percent at least somewhat likely to purchase a foreclosed home in the future