Ever since I introduced my Manhattan Rental Market Overview last year, I’ve been playing around with price/rent multipliers and concluded that something has to change. Either prices need to fall or rents need to rise in order to get out from under the credit fueled ownership premium buyers were paying during the boom. I used median sales price versus median rent (annualized).

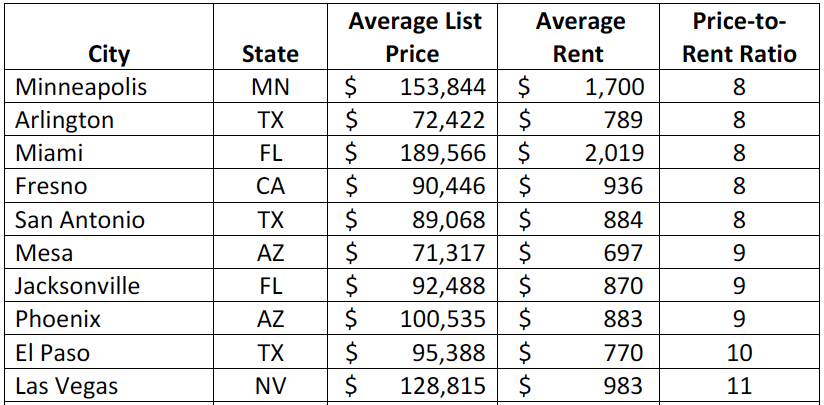

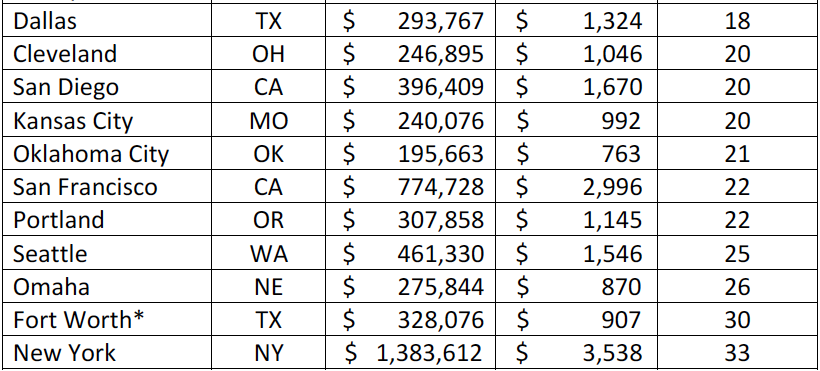

Trulia created the Trulia.com Rent v. Buy Index that is based on the 50 largest US cities by population and divides the average listing sales price by the average listing rental price using 2-bedroom apartments, condos and townhomes.

Top 10 Cities Cheaper To Own Than Rent

[click to open full index]

>At the peak of the real estate bubble, cities like Miami, Phoenix and Las Vegas were not affordable for many. Now the opposite is true,” said Pete Flint, co-founder and CEO of Trulia. “Home sellers in these hard hit areas are forced to lower their prices to compete with all the foreclosures on the market. As a result , these unattainable markets are so affordable it makes better financial sense to buy than rent.

Top 10 Cities Cheaper To Rent Than Own

[click to open full index]

That’s the theory since affordability is now so favorable to purchasers – however the problem with some of the former speculative markets which are now very affordable to buyers, is the fact that financing isn’t readily available because of shadow inventory and significant oversupply. There was so much overbuilding back in the day that there aren’t enough buyers now and the mortgage lending net is not cast nearly as wide.

If the Price-to-Rent Ratio is:

* 1-15: cheaper to own than to rent

* 16-20: neutral

* 21+: cheaper to rent than own

Trulia.com Rent vs. Buy Index [Trulia]

One Comment

Comments are closed.

[…] Here is the full article about how they obtained the stats, created the index and such for your own edification. http://matrix.millersamuelv2.wpenginepowered.com/?p=8390 […]