It’s time to share my Three Cents Worth (3CW) on Curbed NY, at the intersection of neighborhood and real estate in the capital of the world…and I’m here to take measurements.

Check out my 3CW column that I posted a few weeks ago on @CurbedNY:

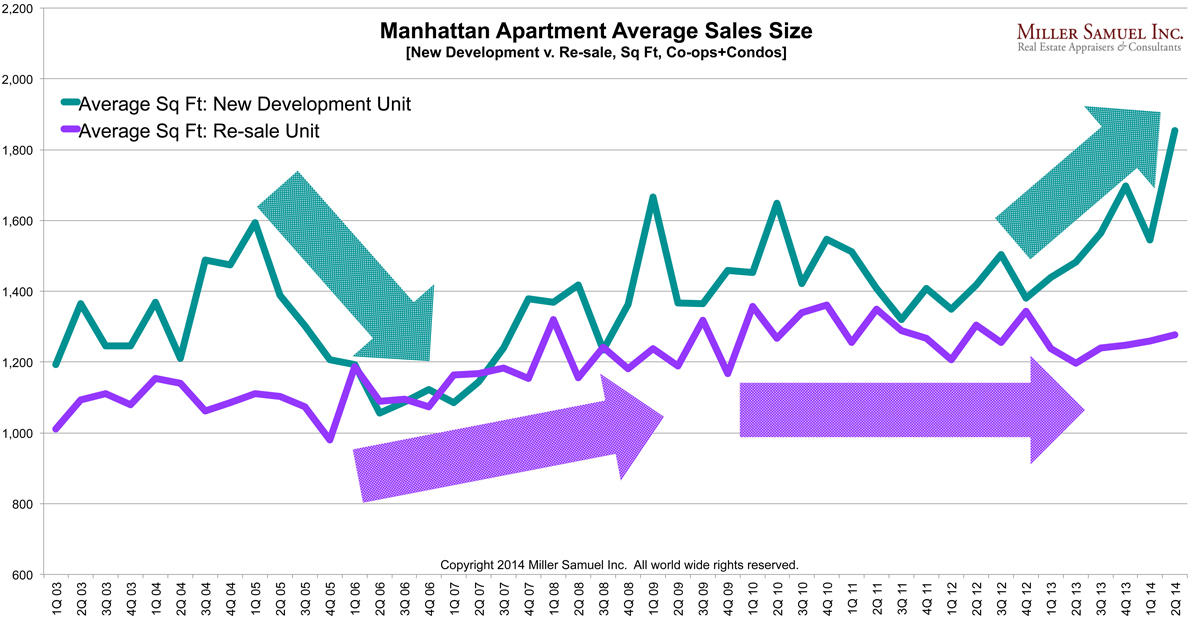

For this chart, I looked at a little more than a decade of Manhattan closed sales by square footage, breaking out the market by new development sales and re-sales. During this period, the average square footage of a new development sale was 1,382—15.6 percent larger than the 1,195 average square footage of a re-sale. However, new development sales size showed significant volatility as developers adapted to the changing market. The underlying driver of volatility is the quest to achieve the highest price per square foot premium a developer realizes by creating larger contiguous space. As a result, the much chronicled “micro-unit” phenomenon falls short and can’t become mainstream under current market conditions without external incentives (i.e. government). The math doesn’t work…

__________________________

My latest Three Cents Worth column on Curbed:

Units In New Developments Grow Larger [Curbed]

Three Cents Worth Archive Curbed NY

Three Cents Worth Archive Curbed DC

Three Cents Worth Archive Curbed Miami

Three Cents Worth Archive Curbed Hamptons