Click here for interactive table (and to see straight)

James Hagerty and Ruth Simon performed their quarterly survey of the US residential housing market in 28 metro areas.

While the general state of the majority of the 28 residential markets were weak, the stats showed some light at the end of the proverbial tunnel, although I suspect that means 2009. The big wild card now is the state of consumer credit. Restrictions placed on the sale of properties overlay more difficulty in obtaining mortgages and thereby restrict the odds of recovery anytime soon.

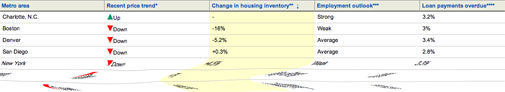

>Tighter credit is prolonging a deep slump in home sales, but a quarterly Wall Street Journal survey of 28 major metro areas shows that the surge in inventories of unsold homes is slowing. In two of those markets — Boston and Denver — the number listed for sale has actually declined from a year ago.

>Home sales and prices generally should bottom out around mid-2008, says Mark Zandi, chief economist at Moody’s Economy.com, a research firm in West Chester, Pa. “The market will not revive quickly, however,” he says. “It won’t be until the turn of the decade before housing activity returns to more normal conditions.”

I agree. Zandi is really saying 2009-2010 before things return to normal (whatever normal really means).

The NAR released their monthly existing home sale stats yesterday indicating more weakness as the number of existing sales fell 3.8% below the same period last year. Since these are the numbers for June, which is one of the most active months of the year for residential real estate, the decline suggests more weakness on the way.

The day before, Countrywide reported a 33% drop in net income, which triggered a 200 point drop in the stock market on Tuesday. Angelo Mozilo, CEO and cofounder blamed housing. It was surprising that Countrywide reported weak earnings since Mozilo has always been direct about the housing market so it would seem that they would have anticpated the current state of affairs (He also has the best sun tan of any Fortune 500 CEO).

Today, the DJIA dropped 311.50 on lending and credit worries. Take a listen to the mp3 in the article. Its worth listening too, plus the interface is very slick (NYT Radio?) Home builders reported lower earnings, combined with $77 dollar a barrel oil and several days of bad housing news caused some jitters.

However, relative to 14,000, a 311.50 drop doesn’t seem that catastrophic as the housing hyperventilating suggests.

This week has been a heck of a housing party.

One Comment

Comments are closed.

When the category is NY, that means all five boroughs. Correct? Are there any numbers to further break down this particular information borough by borough? Otherwise the data for all five boroughs leaves really no clue as to what is happening in each borough and therefore seems not really usable information. I’m only concerned with what is happening in Manhattan and those numbers which are also colored by four other boroughs doesn’t tell me anything of value.