Two sides are presented as to why the bond market yields have remained low, which has extended the housing boom and has been counter to historical patterns:

Why is the bond market right? Investors are buying bond yields at low rates because they believe the economy will slip. A flat yield curve often pre-dates a recession. Also, the bond market is not concerned about growth right now, only inflation. With central banks keeping rates low as well as heated competition from Asia. Also, demographics may be keeping yields low. The 25-44 year old age group is shrinking so consumption growth should shrink as well keep rates low in the long term.

Why is the bond market wrong? A recession is not in the forecast and the equity (stock) markets are not worried about one. Also, there may be a global savings surplus – and we hear this a lot – there is so much capital out there, seeking out limited opportunities for investment. A potential revaluation in the Yuan, high US budget deficit and further inflationary economic data would cause yields to re-adjust to proper levels. There was an article today in the [Wall Street Journal that suggests that global inflation may return.](http://online.wsj.com/article_print/SB112915099686067060.html)

The sharp rise in energy costs and economic damage caused by the 2 recent hurricanes has added to the pressure.

In other words, no one really knows what the long term outlook is for bond yields. Yet it is critical to the housing market since mortgage rates are usually tied to bond yields.

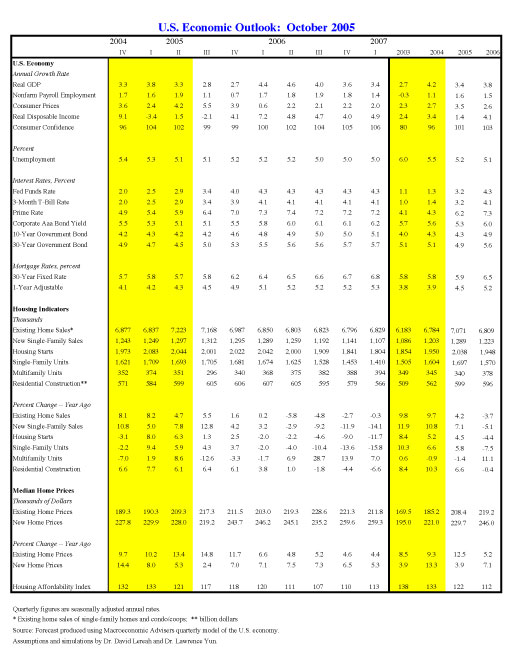

On the other hand, the [NAR’s Home Sales Forecast is rising [RisMedia]](http://www.rismedia.com/index.php/article/articleprint/12141/-1/1/)

[[NAR’s 10-2005 US Economic Outlook] [PDF]](http://www.realtor.org/Research.nsf/files/currentforecast.pdf/$FILE/currentforecast.pdf/)