The St. Louis Fed, in their Economic Synopses publication contained a research piece called Home Prices: A Case for Cautious Optimism (Hat tip: Joe Weisenthal over at BusinessInsider) that does a great job lining up 3 housing related indexes and makes the case that we aren’t through yet despite positive month over month trends of the past 6 months.

The title for this Fed research piece is simply wrong. It should be re-named: Home Prices: Not Much of a Case for Cautious Optimism.

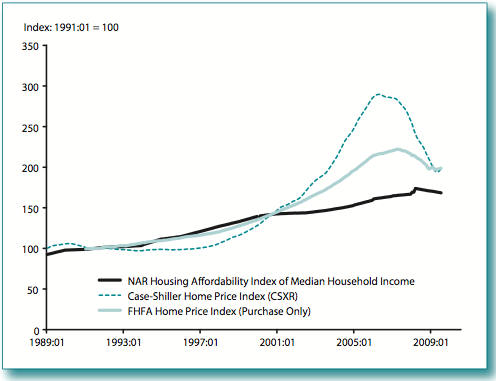

The chart shows the Case Shiller Home Price Index, FHFA Home Price Index and NAR Housing Affordability Index of Median Household Income presented in alignment.

Here’s the problem with affordability as a measurement – it considers income, housing prices and interest rates but not the tightness of credit, which is THE story at the moment. The affordability index is significantly optimistic right now because of this gaping void over credit.

Its great to have lower prices for all those buyers only if they can get a mortgage to take advantage of the opportunity. Mortgage underwriting is very tight right now and therefore we are looking at a 3 legged kitchen table that originally had 4 legs.