Last week S&P made the decision to de-emphasize seasonal adjustments given the chaos of the past several years. A good move towards better transparency.

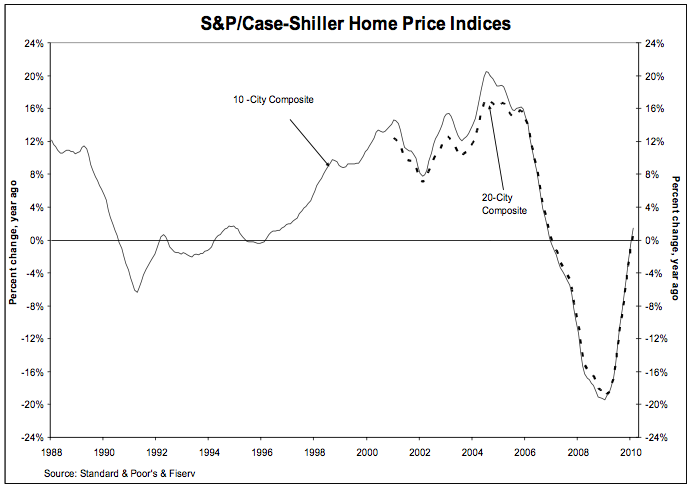

The S&P/Case Shiller Index showed:

* 0.6% increase year over year, first in about 3 years – caused by the tax credit.

* 20-City Composite is down 32.6% since June/July 2006.

* Month over month decline in 19 of the 20 cities in the index.

* 0.9% decline from January to February 2010, 5th consecutive monthly decline.

* As of February 2010, average home prices across the United States are at similar levels to where they were in late summer/early autumn of 2003.

After 5 consecutive months of m-o-m declines, the Case Shiller Index is feeling the influence of rising foreclosures and a possible housing double dip, despite the stimulus in sales activity from the multiple federal tax programs.