Contract activity another way to track housing trends although it’s reliability is fraught with risk since it is a much smaller data set and therefore subject to skew, especially on a local level. However, on a national level (as far as that goes) it is the only index of this kind we have.

From Reuters/NYT:

>Pending sales of existing U.S. homes rose sharply in August, for a seventh consecutive month of gains, reaching the highest since March 2007, data from a real estate trade group showed on Thursday.

And the NAR press release:

>Pending home sales have increased for seven straight months, the longest in the series of the index which began in 2001, according to the National Association of Realtors®.

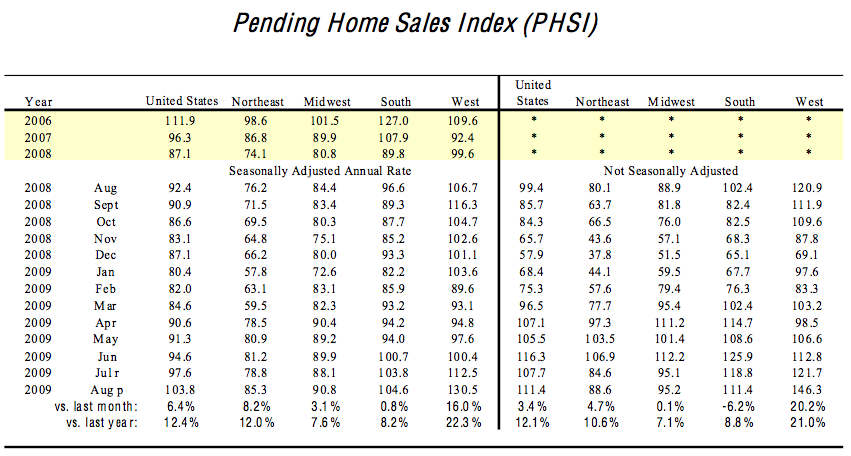

>The Pending Home Sales Index, a forward-looking indicator based on contracts signed in August, rose 6.4 percent to 103.8 from a reading of 97.6 in July, and is 12.4 percent above August 2008 when it was 92.4. The index is at the highest level since March 2007 when it was 104.5.

[Recommendation to NAR] – contracts are not “forward looking” but rather they are “current looking.” Housing futures indexes like Case Shiller are designed to be “forward looking.” PHSI is forward looking as far as it relates to closed sales but not as a way to predict the future market trend in real terms.Here are the raw PHSI data points.

Seven months of m-o-m seasonally adjusted contract sales activity is certainly encouraging, especially because it is an index of sales rather than prices. Honestly, in light of what is happening on the foreclosure front, I am not sure what this run of good news actually infers.

br clear=”all”>