Last month home sales spiked as first time home buyers rushed to take advantage of the tax credit before the November 30 expiration and no one was sure that the credit would be extended. As a result, the December sales reflect the sharpest decline in existing home sales in 40 years.

From the NAR press release for existing home sales:

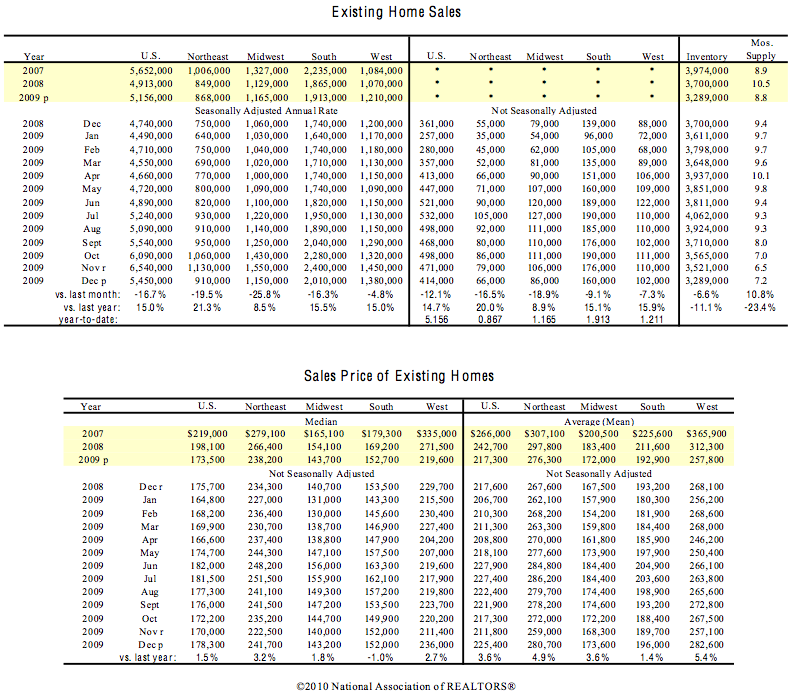

>After a rising surge from September through November, existing-home sales fell as expected in December after first-time buyers rushed to complete sales before the original November deadline for the tax credit.

>fell 16.7 percent to a seasonally adjusted annual rate1 of 5.45 million units in December from 6.54 million in November, but remain 15.0 percent above the 4.74 million-unit level in December 2008.

NAR couched the bad news with a sprinkling of good news:

* 5,156,000 existing-home sales in 2009, 4.9 percent higher than the 4,913,000 transactions recorded in 2008; the first annual sales gain since 2005.

* National median existing-home price for all housing types was $178,300 in December, 1.5% higher than 2008

The worry here is not about the 16.7% decline – the concern is the removal of the tax credit as a stimulus for demand. I’m not advocating one way or the other – I am merely observing that housing does not yet stand on its own two feet so calling a bottom or a recovery is a mischaracterization.