I wrote “The Decline In Inventory Right Now is NOT a Good Sign” back in February, but there has been a more refined discussion about low inventory recently. Back then my orientation was more about the “robo-signing” scandal causing a drop in distressed listings as servicers held back supply – as well as the lack of confidence by sellers over whether they can achieve their price.

Stan Humphries, chief economist of Zillow has been a guest on my podcast and penned a great piece about it a few weeks ago called “The Connection Between Negative Equity, Inventory Shortage and Increasing Home Values: Why the Bottom Won’t Be as Boring as We Expected” tackling the impact of negative equity on inventory.

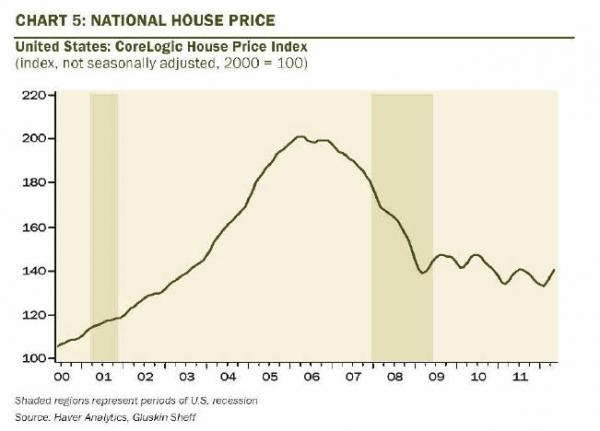

CoreLogic reported (via Nick Timiraos/WSJ) that the supply of homes for sale declines as negative equity increases.

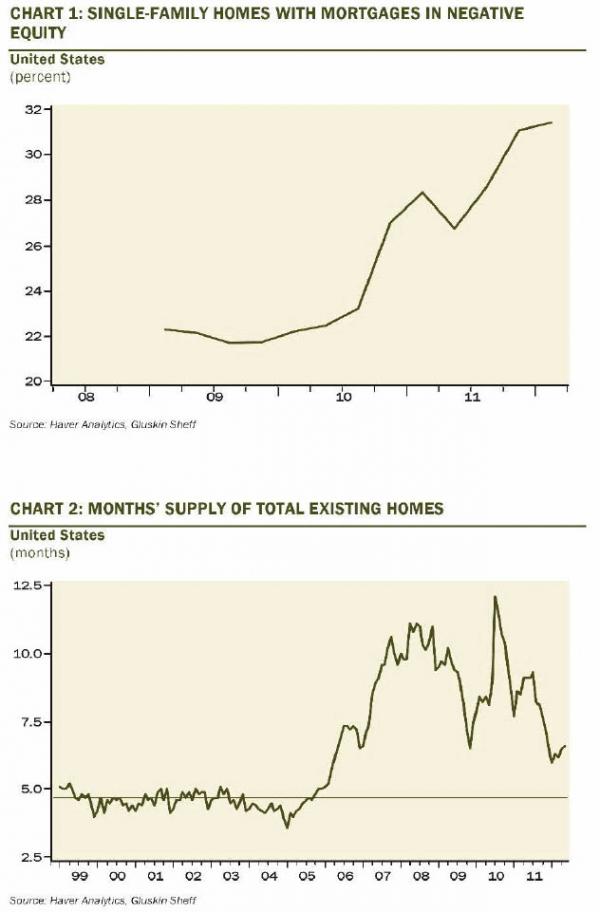

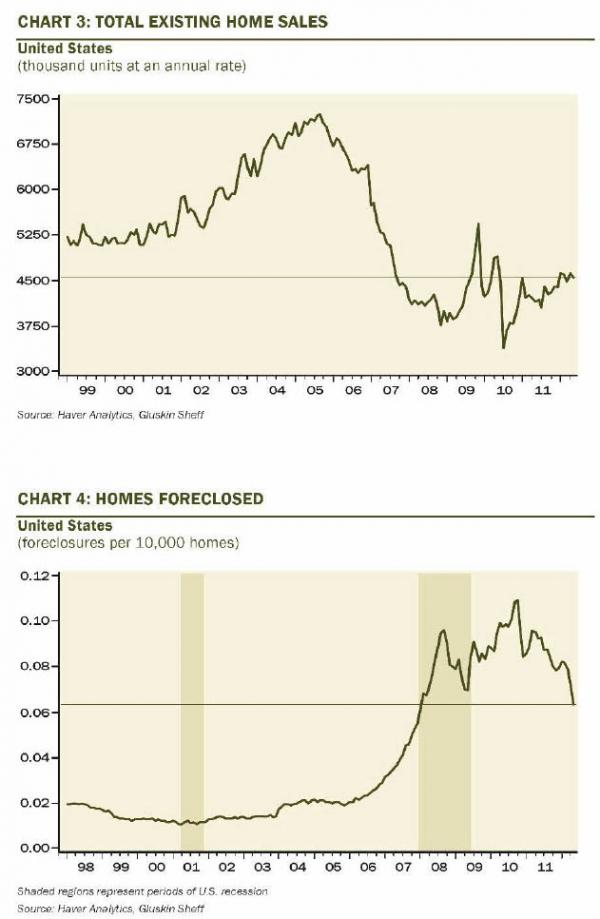

David Rosenberg, chief economist as Gluskin-Sheff, and whom I had the pleasure of meeting with for dinner a few months ago, presented a great series of charts in his newsletter (via ZeroHedge).

It basically presents the idea that “upside-downers” ie those with negative equity, can’t list their homes for sale because they don’t have equity (or enough equity) for the next one.

Here’s the most compelling excerpt:

According to data cited by the USA Today, the supply backlog where over half of homeowners are “upside down” on their mortgage is at 4.7 months’; in areas where “upside down” borrowers make up less than 10% of the market, the listed inventory is closer to 8.3 months’ supply.

In other words, in markets with unusually tight inventory, prices are being “goosed” higher, not because the housing market is improving, but because there are fewer houses in the game. Low mortgage rates are artificially creating excess demand, with those buyers fighting over the slim pickings of sellers who can actually sell.

That, my friends, is NOT a housing recovery.

More visuals:

_____________________________

The Decline In Inventory Right Now is NOT a Good Sign [Matrix] David Rosenberg Explains The Housing “Recovery” [Zero Hedge] The Connection Between Negative Equity, Inventory Shortage and Increasing Home Values: Why the Bottom Won’t Be as Boring as We Expected [Zillow Real Estate Research] Why Aren’t There More Homes for Sale? [WSJ Developments Blog/Nick Timiraos]

9 Comments

Comments are closed.

[…] I wrote “The Decline In Inventory Right Now is NOT a Good Sign” back in February, but there has been a more refined discussion about low inventory recently. Back then my orientation was more about the “robo-signing” scandal causing a… Read More […]

[…] One of my most trusted resources I read in the biz, Jonathan Miller, says this: low housing inventory is NOT a sign that the market’s back, it’s a sign that some people, the upside downers, maybe CAN’T list their home. When you have negative equity, you don’t have enough equity to buy the next home, even if it is a cheaper home. Hell, you may not even have enough cash to pay a mover. What do you do? You stay put if you can squeak by, make the monthly payments. You do not pass go, you are stuckola. You pray one of you doesn’t get transferred. […]

[…] – Low Housing Inventory Is NOT A Sign of Recovery (Housing analyst Jonathan Miller) […]

[…] But … lower housing inventory is not necessarily a sign of recovery. […]

[…] But … lower housing inventory is not necessarily a sign of recovery. […]

[…] Low Housing Inventory Is NOT A Sign of Housing Recovery […]

[…] 1 – In some segments of the Charlottesville – Albemarle MSA (Metropolitan Statistical Area), the buyers’ market looks like it’s over. Good houses that are priced well are moving … sometimes in a matter of days and occasionally with multiple offers. Inventory is down, some prices are up. (Low Inventory isn’t necessarily a sign of recovery though) […]

Low Housing Inventory Is NOT A Sign of Housing Recovery. This post is very realistic. Owning real estate right now can be a tenuous proposition. Many people that we talk to bought their houses in the last 7 years or so. Unfortunately they bought their properties at the height of the real estate market. Now so many people are upside down, owing more than their house is worth. Being upside down in and of itself is not necessarily a terrible thing. If you can still make your payment comfortably and are reasonably sure that the value of the property will eventually be worth more than you paid for it, then you can ride out the market.

[…] Inventory Resumes Upward Climb | ZeroHedge Low Housing Inventory Is NOT A Sign of Housing Recovery Low Housing Inventory Is NOT A Sign of Housing Recovery | #MillerSamuel @jonathanmiller There is a wealth of information on the WEB. You must not have the ability to it. Your statement […]