The Wealth Report 2010 was released today by Knight Frank Research. It is a much anticipated annual survey targeted at the high end consumer with great detail on global residential property trends. The report covers 56 high end housing markets across the globe.

Check out The Housing Helix podcast for my interview with Andrew Shirley, Editor and Liam Bailey, Head of Residential Research for the Knight Frank Wealth Report 2010.

I had provided commentary on the NYC housing market for the report.

>….While the market has undoubtedly improved compared with last year,

we ought not to get too excited. The recovery of late 2009 was a short-term

uptick, due in large part to a release in pent-up demand. My view is that the

surge in demand is not the start of a rising housing market. While sales are

up sharply, prices have moved “sideways.”…

Some interesting data points:

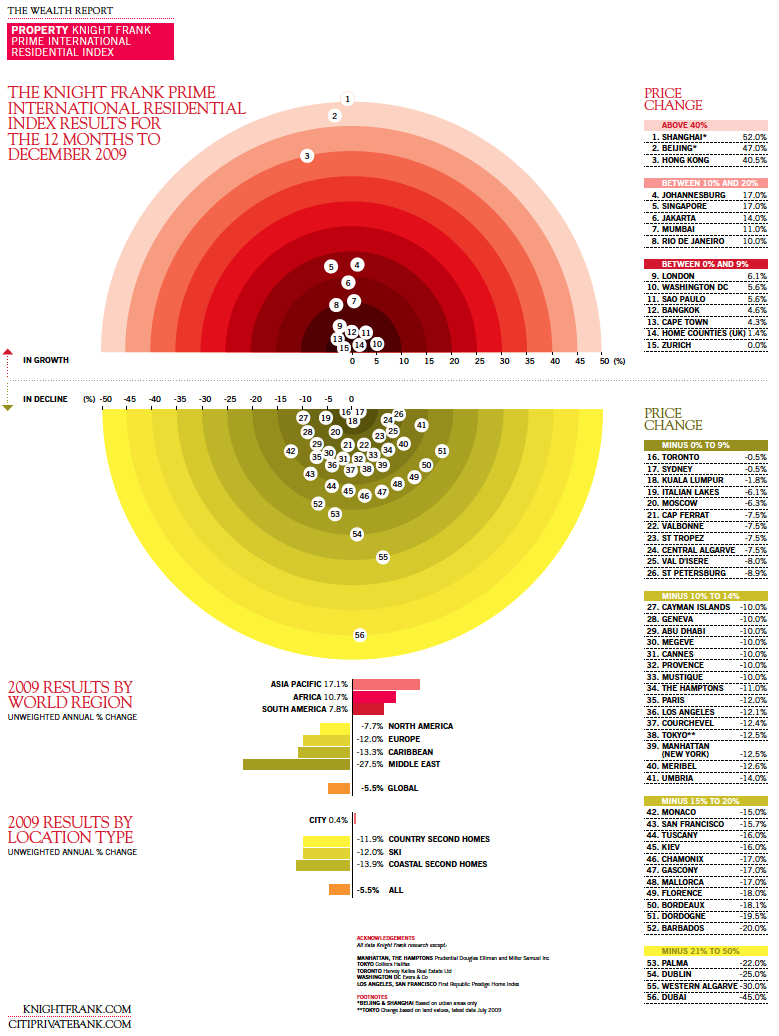

* Overall annual global decline was 5.5%

* Monaco saw prices as high as $5,900 p/SF US.

* 73% of cities saw year over year declines versus 40% last year.

* Middle East down 27.5% – the largest decline – Dubai showed a 45% drop.

* Asia Pacific up 17.1% – the highest increase – Shanghai showed a 52% gain.

>In light of this strong growth, the Hong Kong

government has threatened measures to restrict the

market – notably through mortgage lending restraint,

reducing, for example, the mortgage limit for luxury

property from 70% to 60%. Despite these potential

restrictions the market continues to grow.

>This example points to an interesting

development. The crippling impact of property

bubbles bursting in Europe and the US has created

a much more confidently interventionist approach

in China, Hong Kong and Singapore (where cooling

measures were introduced in September last year)

among other markets.

Listen to the interview with Knight Frank [The Housing Helix Podcast] Download The 2010 Wealth Report [Knight Frank]

Update: Just came across the Bloomberg video and my interview giving a quick take on the US luxury portion.