Where we’ve been

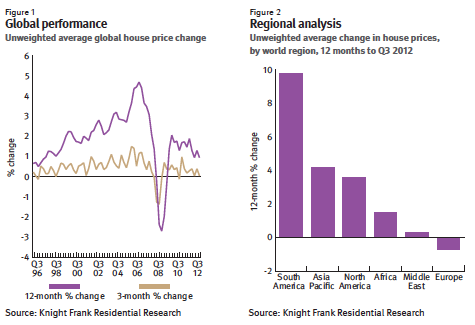

Knight Frank’s Global House Price Index is published quarterly and tracks the performance of mainstream national housing markets around the world. They use Case Shiller results for the US market.

Europe at bottom:

With the Eurozone now in its second recession

in three years buyer confidence is at an all-time

low and it is no coincidence that all the bottom

12 rankings are occupied by European countries

this quarter.

The top performers:

But it’s not all bad news. Six markets recorded

double-digit annual price growth in the year to

September; Brazil, Hong Kong, Turkey, Russia,

Colombia and Austria.

Where we’re going

I help provide their Manhattan and Miami insights and they liked the way I characterize the state of luxury housing as a “safe-haven” and the “new international currency.” Here are the top line observations in their Q4 12 Prime Global Forecast:

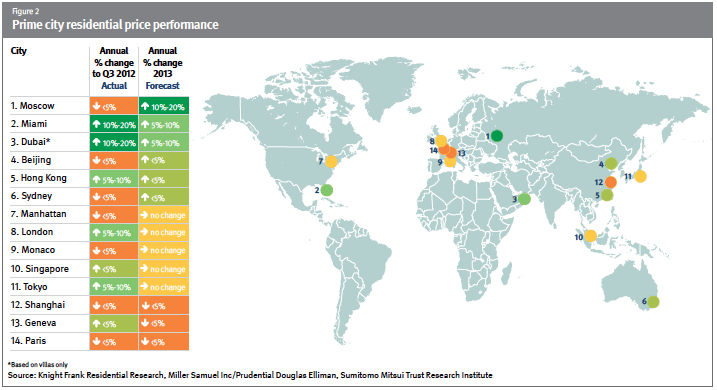

• In 2013, we expect prime residential prices across the 14 cities included in our

forecast to rise by 2.5% on average, with Moscow, Miami and Dubai being the

strongest performers.

• A sharp slowdown in the global economy is the highest risk for the world’s

prime residential markets closely followed by government cooling measures.

• However, the current economic uncertainty is also considered a key driver of

demand in prime cities as HNWIs seek the shelter of ‘safe-haven’ investments.

• Supply, or the lack of it, will be a key determinant of price performance in cities

such as New York, Moscow and Miami in 2013.

• We envisage that government-imposed regulatory measures will keep a lid on

price growth in Asia in 2013 but the west-east shift in the economic balance of

power suggests more promising prospects in the medium term.

________________

Q3 12 Global House Price Index [Knight Frank] Q4 12 Prime Global Forecast [Knight Frank]