Our friends across the pond at Knight Frank just released their Q3 2012 Prime Global Cities Index which our firm and Douglas Elliman in NYC and Miami contribute content to.

Miami was #3 after Dubai although that placement was exagerated by the drop in distressed sales in south Florida (and they will rise going forward). Still, Miami has come a long way in 2 years. Manhattan showed decline but most of that was attributable to the shift in mix to entry level sales as mortgage rates continue to fall to new record lows. However it’s quite interesting to look at Manhattan as more mundane a market than the super-luxury segment would suggest. Further proof that the top end is not a proxy for everything else.

Cities such as Dubai, Miami, Nairobi and London

are increasingly considered investment hubs for

HNWIs in their wider regions. In the wake of the

Arab Spring, Dubai has been seen as a relative

safe haven for MENA buyers while Venezuelan

and Brazilian investors have looked to Miami

to limit their exposure to domestic political and

economic volatility.

HNWI = High Net Worth Individual

Here’s KF’s top line overview:

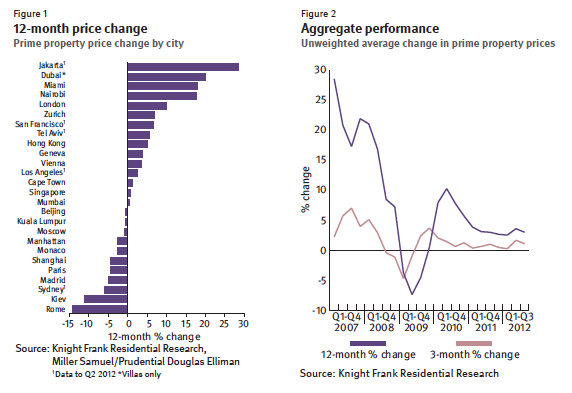

-Fifteen of the 26 cities tracked by the Prime Global Cities Index (58%) recorded flat or positive price growth in the year to September, but over the last quarter 20 of the 26 cities (77%) have seen flat or positive growth – indicating an improving scenario.

-The index now stands 18.7% above its financial crisis low in Q2 2009 with Hong Kong, London and Beijing having been the strongest performers over this period, recording price growth of 52.9%, 45.4% and 39.5% respectively.

-Five cities recorded double-digit price growth in the year to September; Jakarta, Dubai, Miami, Nairobi and London – a city from each of the five key world regions.

_____

Q3 2012 Prime Global Cities Index [Knight Frank] The Elliman Report: 3Q 2012 Manhattan Sales [Prudential Douglas Elliman] The Elliman Report: 3Q 2012 Miami Sales [Douglas Elliman]