Getting Graphic is a semi-sort-of-irregular collection of our favorite BIG real estate-related chart(s).

Here’s a smorgasborg of mortgage related charts:

Investors are betting that the Fed will cut rates in September which likely won’t influence mortgage rates to fall, but could help stabilize the mortgage markets, eventually tempering non-conforming rate increases…

As credit tightens…

And debt grows…

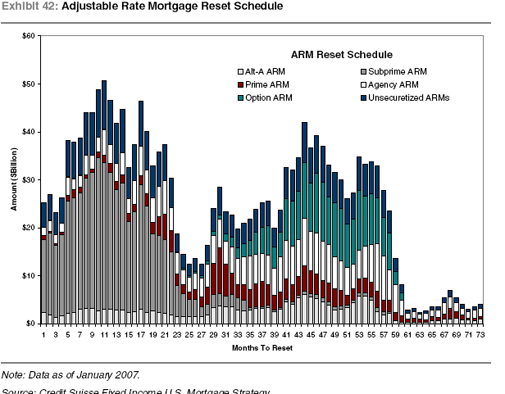

And ARMs reset…

Next March is going to get interesting…

update: (Chart shows dollar value, in billions, of the adjustable mortgage resets)

(This chart is all over the Internet but I was unable to find the source or credit)

9 Comments

Comments are closed.

sorry…. i could use a header on that last chart. what does it mean?

Interesting indeed.

It seems that note holders have been buying back houses for the mortgage amount at foreclosure auctions to keep from having to write down the loans. But at some point they will have to dump them before taxes, deterioration and other costs eliminate whatever value is there. They certainly don’t want to dump them in the current mortgage environment.

Perhaps in the spring, they’ll see prices aren’t rising and dump them for what they could get. With an FHA type program for insured low downpayments, there could be lots of “affordable housing” out there for responsible bona fide homeowners.

just added – sorry about that!

[…] [Getting Graphic] Resetting Perspective On <b>Mortgages</b> […]

what it means, is that if you think things are bad now, wait til march. if interest rates are increasing, and loans that are subprime/alta mortgages are adjusting, people that bought homes with lower mortgage rates will either NOT be able to get a new mortgage, or the adjusted rate they pay on their home will be so high they will not be able to afford it.

here’s some quick math. take a home for $230k which wouldn’t buy you a condo in NYC but is the average home price. if the borrower had a 5 year arm at 5.25% they would be paying $1,270. if the loan adjusts to libor plus margin (2.75 lets say their margin and libor is 5.25) that’s 8%. that makes their monthly payment $1,7875 ~ 500 bucks more. the people that are buying a home for 230k CANNOT afford 500 more bucks a month….

I’m a bit confused. Isn’t the bar chart (“Exhibit 42”) a graphic representation of the table of from Seeking Alpha? how could those numbers be so different?

According to the bar chart, March08 (counting about 15 months from January 2007, as per the chart’s legend) shows a value of about $35-40 billion.

Interesting,

I’d just like to know what will happen to interest rates when there are all the adjustments. How much will they really reset and go up? Or will the difference be only minimal? Are most of these pay option arm loans with minimim payment and reverse amoritization, or just simple 3-year, 5 year fully amortized arms?

Does anybody know what the average increased monthly payment will be on these resetting arms? Is it really crisis figures, or just a few hundred dollars per person?

Where can I find information on the percentage of home owners with ARMS in a given area?