Getting Graphic is a semi-sort-of-irregular collection of our favorite BIG real estate-related chart(s).

An Inman News story (subscription) covered the release of a new study of the relationship of default rates and housing appreciation:

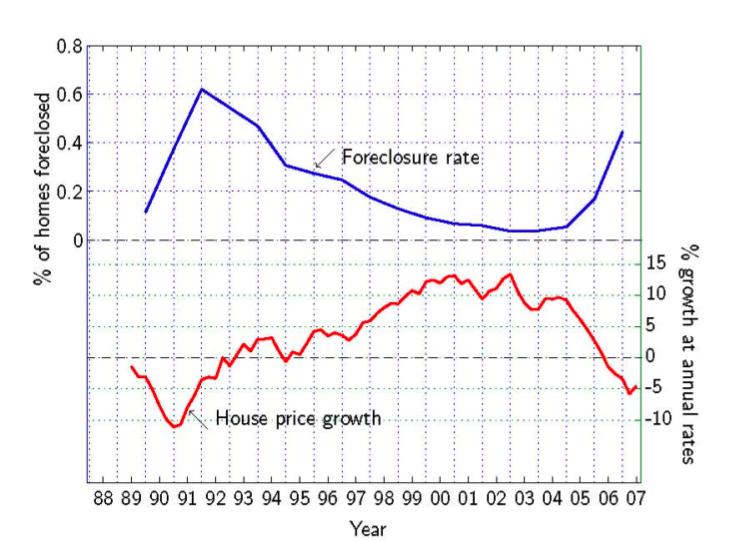

>House price appreciation plays “a dominant role” in generating foreclosures, according to a study released today by the Federal Reserve Bank of Boston, “Subprime Outcomes: Risky Mortgages, Homeownership Experiences, and Foreclosures.”

The idea that lower rates of appreciation in a market would lead to higher default rates as borrowers are unable to refinance their way out of trouble.

>The study, of the Massachusetts housing market from 1989 to 2007, found homes originally purchased with a subprime purchase mortgage ended up in foreclosure about 18 percent of the time, or more than six times as often as those purchased with prime purchase mortgages

>About 30 percent of foreclosures in the state during 2006 and 2007 were traced to homeowners who used a subprime mortgage to purchase their house.

>A higher percentage — almost 44 percent of foreclosures — were on homes whose last mortgage was originated by a subprime lender. About six out of 10 of those borrowers had originally purchased their home with a prime mortgage, and then refinanced into a subprime mortgage.

4 Comments

Comments are closed.

wowwww great representation!!!

“A higher percentage — almost 44 percent of foreclosures — were on homes whose last mortgage was originated by a subprime lender. About six out of 10 of those borrowers had originally purchased their home with a prime mortgage, and then refinanced into a subprime mortgage.”

I hadn’t heard this before, but it isn’t surprising. I remember one couple I dealt with who had gotten over their head in debt, refinanced to consolidate, and claimed that this was a life saver and they had learned their lesson. I got a call less than 6 months later and they were back in the same situation, but with less equity. Home appreciation was a great enabler.

I indeed agree, very good representation!

[…] declines will determine extent of subprime crisis – Inman News (subscription required), by way of Matrix Sphere: Related […]