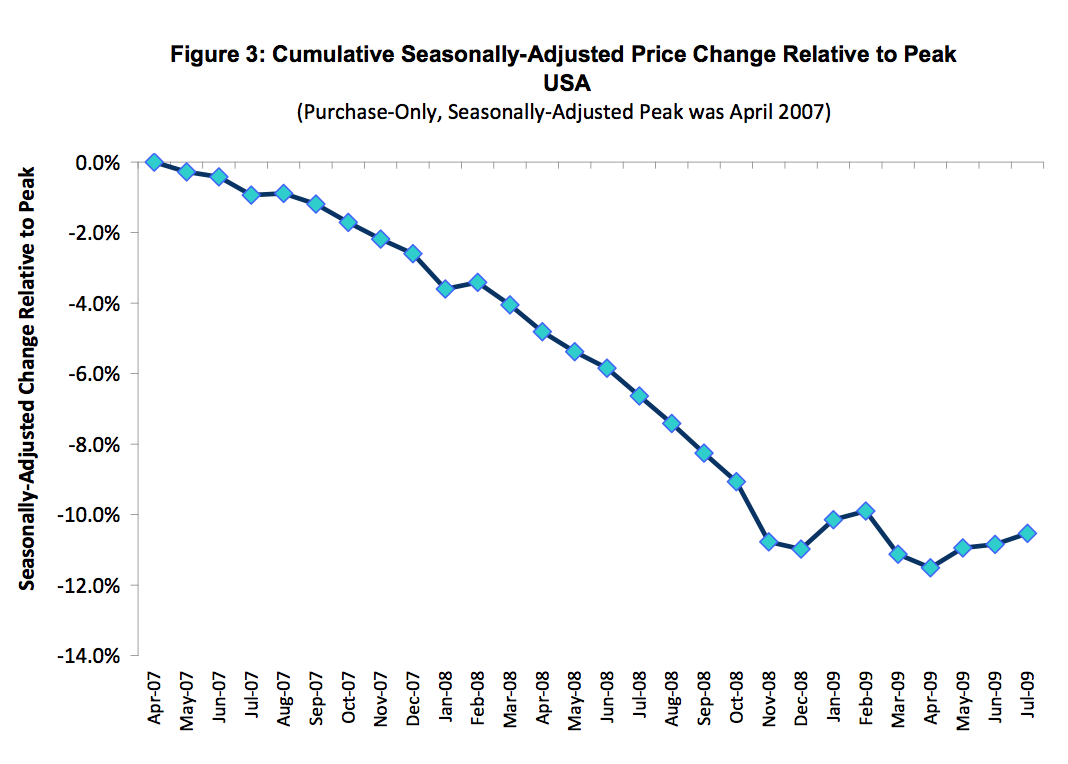

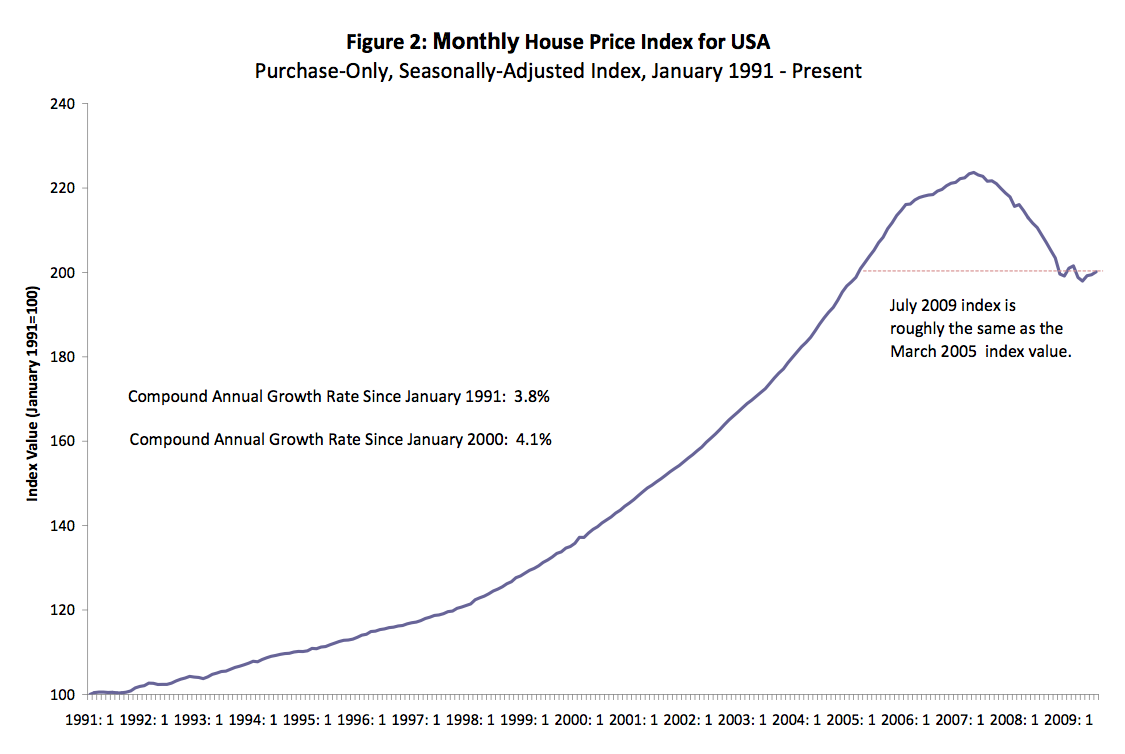

FHFA released its July 2009 monthly housing price index report today which showed more of the same – month over month price increases (up 0.3% from June) and year over year decreases (down 4.2%).

Since OFHEO (pronounced O-Fay-O), I’ve been wondering how to pronounce FHFA and not be kicked out of Acronym Heaven (aka Washington, DC). Kathleen Hays of Bloomberg Radio interviewed me today on her new show “The Hays Advantage” M-F 1-3pm EST and dubbed FHFA (Foo-FA). That works for me.

While it is encouraging news that the bottom isn’t falling out of the housing market, this index basically reflects the low to mid layers of the housing market since it is based on data from Fannie Mae and Freddie Mac, who only handle conforming mortgage products. Currently this means mortgages of $417,000 or less in most of the country and $729,750 in the handful of “high priced” housing markets. That is the market that is recovering first since it has a secondary investor market for bamnks to sell their paper too and ifree up their capital.

I find it a bit troublesome that, as we hang on the edge of our seats each month, the revisions for prior releases are all over the map. Last month, the month over month was 0.5% (6% annual) which was revised downward to 0.1% (1.2% annual). Still, the news is better than its been.

If you are a believer in trend lines, the following chart suggests we have about 10% more to go until the market reaches the trend broken circa 2001. That means that the sideways motion we are experiencing would have to change for the worse over the next several years. Factors could include more foreclosures, rising mortgage rates, elimination of first time home buyers tax credit, etc. While I am concerned, thats more bad karma than I can process.

4 Comments

Comments are closed.

Essentially, the $8K tax credit, 0% Fed interest rates, $1.2 Trillion in MBS security purchases, and $800B Federal stimulus have basically bought us a period of time of sideways price action. Unfortunately, once this has been used up, we’re probably headed down again towards the 2001 price trend that you point out.

Why did you pick 2001 for a target?

Not that 2001 was a target – that was where the prior trend was left behind and the acceleration of the index began. Its only if you subscribe the theory that the “trend is your friend.”

Fair enough. I’ll work on the friend thing.