Weakness in the national housing market hasn’t really hit the banking sector results yet, or so it would appear to be the case. Here are a few thoughts:

Banking Profits/Credit Quality

On Friday the Federal Deposit Insurance Corp (FDIC) announced that banks and thrifts reported record earnings in 2006, the sixth yearly increase in a row. The FDIC is an independent agency of the federal government created to maintain public confidence in the banking system.

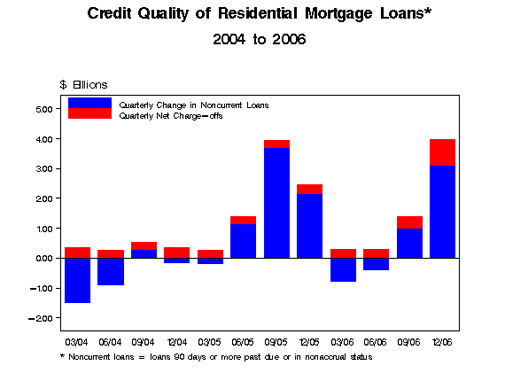

However, credit quality of mortgage loans has fallen as evidenced by the increase in mortgages that are more than 90 days delinquent and the increase in charge-offs.

>Residential mortgage loans that were noncurrent (90 days or more past due or in nonaccrual status) increased by $3.1 billion (15.6 percent) during the fourth quarter. This increase followed a $974 million (5.2 percent) increase in the third quarter. Net charge-offs of residential mortgage loans totaled $888 million in the fourth quarter, a three-year high.

Exotic Mortgages

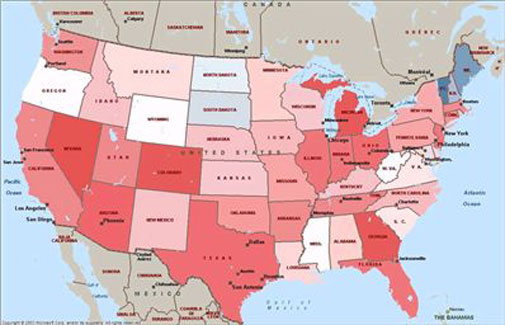

Even negative amortization adjustable rate mortgage (NegAm ARM) delinquencies, the universally loathed and blamed mortgage product of all that is bad with mortgage lending these days (excluding subprime) has remained relatively low so far. The risk of their delinquencies may rise as housing prices fall, especially since these products were more popular in markets that saw the largest levels of appreciation. Its a little premature to attribute the lack of significant problems with these types of loan products as a sign that they really weren’t a big problem to begin with.

Foreclosures

According to RealtyTrac, foreclosures are clearly on the rise. January 2007 versus 2006 saw an increase of 25%. A scary number but percentages can be a little misleading since the hard numbers are not presented as a percentage of the total mortgages outstanding. According to the Mortgage Bankers Association, the December 2006 total delinquency rate was 4.67%, which is not high by historical standards. The largest portion came from subprime loans. However, delinquency is a broader definition than foreclosure, but for argument’s sake, its getting worse.

Click here for full sized graphic.

Risk Assessment

One of the problems with mortgage underwriting during the housing boom was the lack of understanding of risk. Automation and detachment from the collateral itself allowed lending institutions to marginalize the risk, perhaps by pushing it off onto theoretically unaware secondary market investors.

One of my favorite, go-go 1980’s books was Liars’ Poker by Michael Lewis (along with Barbarians at the Gate: The Fall of RJR Nabisco and Den of Thieves).

One of the stars of Liar’s Poker was Lewis Ranieri who helped invent the mortgage backed securities concept – selling bonds tied to mortgages was part of an excellent James Hagerty piece in the WSJ on Saturday called [Mortgage-Bond

Pioneer Dislikes What He Sees [WSJ]](http://online.wsj.com/article/SB117227957162518036-search.html?KEYWORDS=ranieri&COLLECTION=wsjie/6month).

Ranieri and his colleagues in the late 1980’s (thoughts of my Liar’s Poker readings included them bragging about having more powerboats than polyester suits and how they ate onion cheeseburgers for breakfast) combined

>regular mortgages into giant pools of loans that could be divided up and resold as bonds to pension funds and other institutional investors. These bonds come with a variety of credit ratings and are repackaged in endless permutations to meet investors’ varying appetites for risk.

Ranieri’s current assessment of the problem is that today’s investors don’t understand the risk because the expansion of offerings has changed dramatically in recent years and they don’t have the historical perspective.

>The problem, he says, is that in the past few years the business has changed so much that if the U.S. housing market takes another lurch downward, no one will know where all the bodies are buried. “I don’t know how to understand the ripple effects through the system today,”

One of the reasons, has been the meteoric rise in collateralized debt obligations, or CDO’s which are sort of like mutual funds for mortgage securities investors who want to spread their risk. The problem is that he says that buyers of the debt don’t understand the risk like secondary market investors do because they don’t have access to the same level of information.

Take away:

Its ok to work hard for profits, and banks have every right to do that. In fact its their responsibility. However, its also their responsibility to understand the risks that are out there. Mortgage lending played a significant role in the housing boom. I am not confident that the banking industry can remain impervious to the by-product of the aggressive lending we’ve seen in recent years, characterized by the don’t ask, don’t tell mentality. I am surprised that more attention hasn’t been placed on the risks in the mortgage collateral pool (note: faulty valuation of assets).

There hasn’t been enough time for the housing slow down to affect banking’s bottom line yet. We are starting to see signs of weakness in terms of rising foreclosures and noncurrent loans. However, I wonder if there is greater long term risk associated with the lack of understanding of the risks themselves, or simply greater demand for a good polyster suit with cheeseburger grease stains.

2 Comments

Comments are closed.

It’s pretty clear to me out here in California that there is more to default iceberg than is currently visible.

The big run-up in values was fueled during the past few years by a new breed of consumer/speculators using 100% stated income loans to purchase multiple homes concurrently. In several new home subdivisions I work, 40% of the deals were flippers.

The pay option arm problem will deepen because of the high rebates paid which can be hidden in the margin where unwary consumers won’t notice until the reset.

It does seem that the aggressive lending that had continued up until recently will have some large effects on the economy and people’s trust in the mortgage biz. However my question is of a more specific nature. I wonder if you could enlighten me on the subject of bank notes and the purchase there of. Any insight you can give me would be much appreciated.