RealtyTrac has released their monthly US Foreclosure Market Report today and its a mixed bag of results. In other words, its like unemployment. Its at a high level but the pace of increase seems to be abating. In other words, with 3.9 million notices sent to homeowners in default, it is going to take a while for this inventory to clear out.

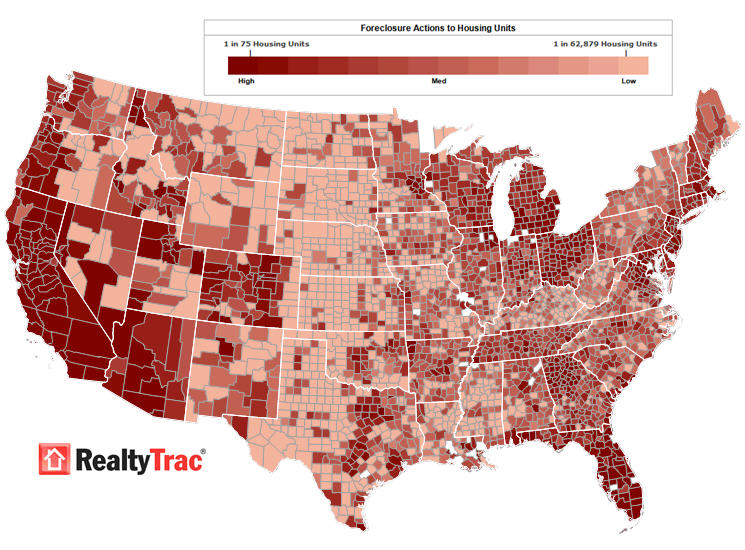

Here are the foreclosure metrics by state.

And a news recap:

> foreclosure filings — default notices, scheduled foreclosure auctions and bank repossessions — were reported on 306,627 U.S. properties during the month, a decrease of nearly 8 percent from the previous month but still up 18 percent from November 2008. The report also shows one in every 417 U.S. housing units received a foreclosure filing in November.

Phyllis Furman over at The Daily News does a nice NYC-centric analysis of the results.

>While foreclosure activity is rising, the percentage of homes at risk here – one in every 1,706 – is small relative to the rest of the country. In November, 306,627 U.S. homes – one in every 417 – received a foreclosure filing. That was up 18.4% from last year, but down 7.7% from October.

And Dan Levy at Bloomberg does a nice US foreclosure recap

>Dec. 10 (Bloomberg) — Foreclosure filings in the U.S. will reach a record for the second consecutive year with 3.9 million notices sent to homeowners in default, RealtyTrac Inc. said.

>This year’s filings will surpass 2008’s total of 3.2 million as record unemployment and price erosion batter the housing market, the Irvine, California-based company said.

>“We are a long way from a recovery,” John Quigley, economics professor at the University of California, Berkeley, said in an interview. “You can’t start to see improvement in the housing market until after unemployment peaks.”:

Statistical nirvana by default (sorry for the pun)

* One in every 417 U.S. housing units received a foreclosure filing in November

* Default notices nationwide were down 8 percent from the previous month but still up 22 percent from November 2008

* Nevada, Florida, California post top state foreclosure rates

* Nevada foreclosure activity – one in every 119 housing units receiving a foreclosure filing in November — 3.5 times the national average.

* Four states account for more than 50 percent of national total: For the second month in a row, the same four states accounted for 52 percent of the nation’s total foreclosure activity: California, Florida, Illinois and Michigan

* Las Vegas drops out of top spot among 10 highest metro foreclosure rates. After four straight months with the nation’s top foreclosure rate among metropolitan areas with a population of at least 200,000, Las Vegas dropped to No. 5 thanks to a 33 percent decrease in foreclosure activity from the previous month. One in every 102 Las Vegas housing units received a foreclosure filing in November — still more than four times the national average.