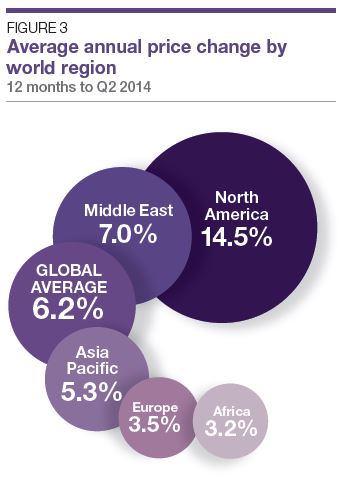

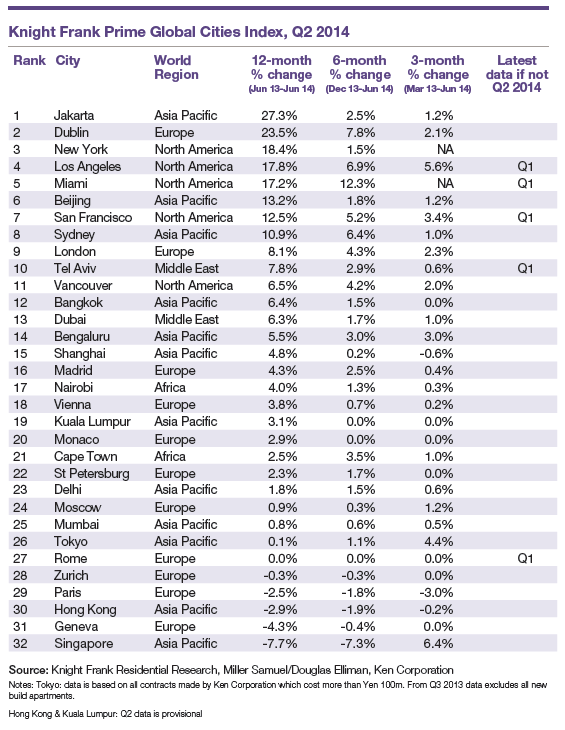

Knight Frank published their quarterly Prime Global Cities Index today and North America led the way as a region with a 14.5% rise in prices. “Prime” translates to “Luxury” in US housingspeak. We provide research for their Manhattan and Miami results through the Elliman Reports we prepare.

The report conclusion succinctly summarizes the state of high end housing today and speaks to the global phenomenon:

…the index’s annual increase of 6.2%

in the year to June is above the long-run

average of 4.6% recorded since Lehman’s

collapse in the third quarter of 2008,

underlining the extent to which prime property

has become a favoured asset class globally.

Here’s the table…