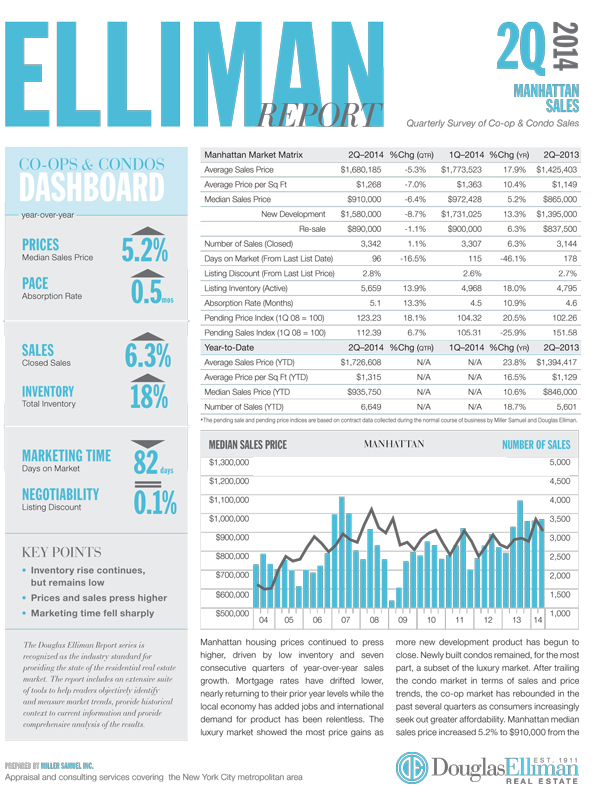

Today Douglas Elliman published the Elliman Report on Manhattan Sales that I author. This quarterly report is part of an evolving market report series I’ve been writing for Douglas Elliman since 1994 (20 years!).

Incidentally, we are tweaking the visual aspects of this Elliman report series – we do this every few years. We added a dashboard to provide at-a-glance information but expanded and yet consolidated the text to be one comprehensive section. I expanded the size of the charts but kept the matrix tables just about the same. Since this is a labor of love and a work in progress, please feel free to send along suggestions.

Key Points

– Sales increased for the 7th consecutive quarter, but less at a lower rate than the 27.6% average quarterly increase of the prior 4 quarters.

– Median sales price for co-ops increased 9% as consumer sought out greater affordability as condos increased 0.8%.

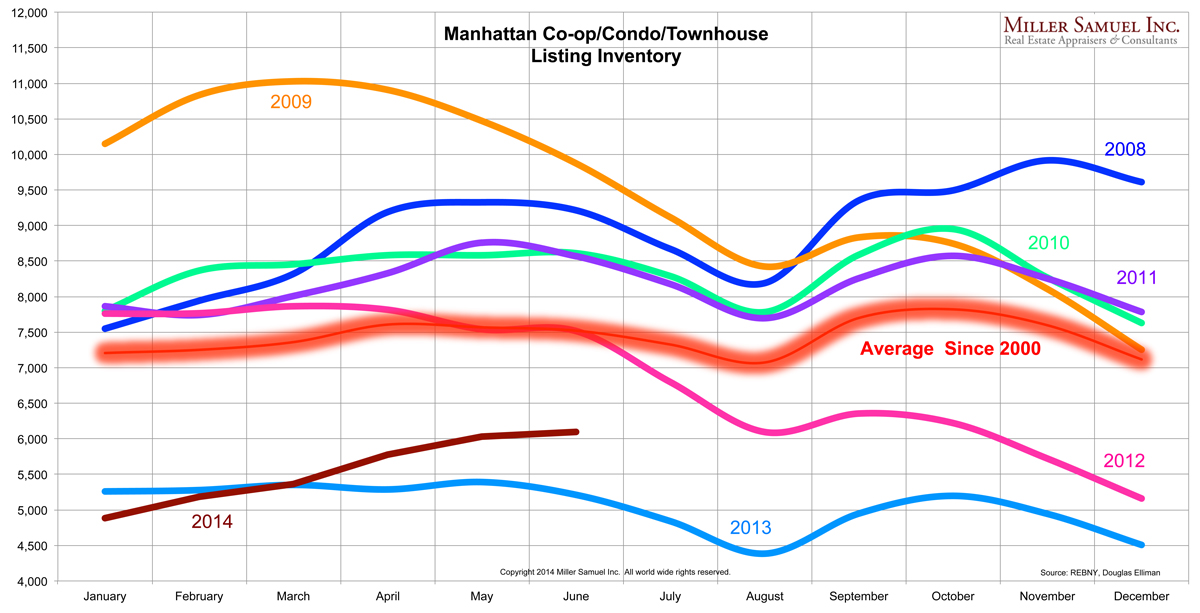

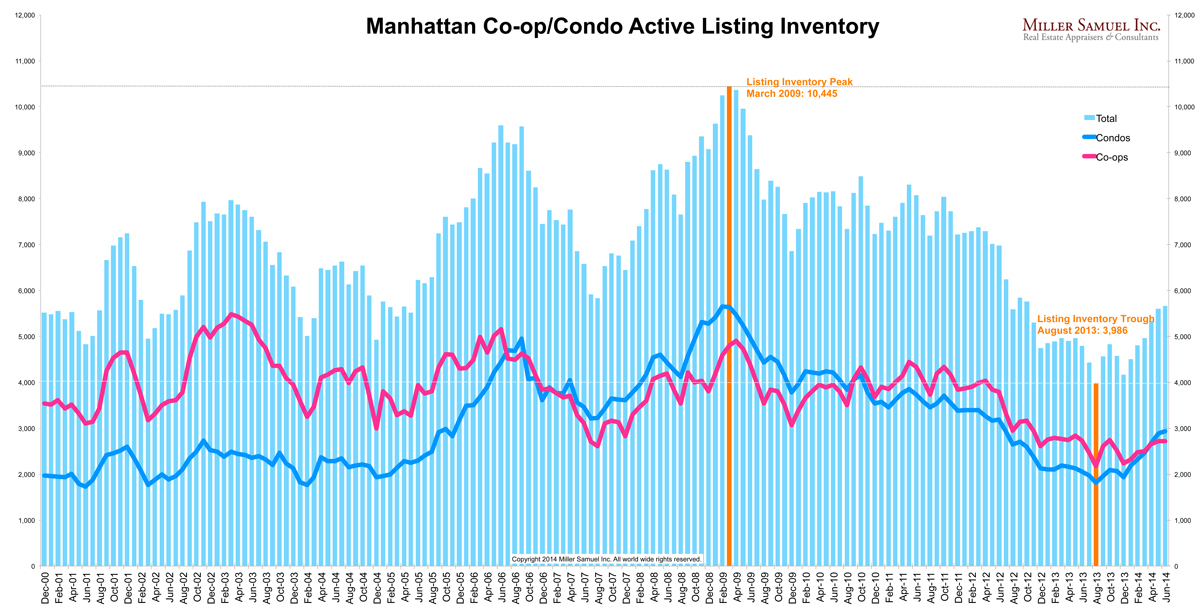

– Inventory is up from last year’s near record low. The inventory bottom appears to have been reached in 4Q 2013.

– There were 45.9% listings that sold at or above list price, the largest market share in nearly 6 years.

– Luxury price increases out paced the overall market.

– Sellers are being both motivated and enabled to list as a result of rising prices.

– Mortgage lending remains significantly challenging to buyers.

Here’s an excerpt from the report:

Manhattan housing prices continued to press

higher, driven by low inventory and seven

consecutive quarters of year-over-year sales

growth. Mortgage rates have drifted lower,

nearly returning to their prior year levels while the

local economy has added jobs and international

demand for product has been relentless. The

luxury market showed the most price gains as

more new development product has begun to

close…

Here is some context on the lack of inventory [click each chart to expand]:

The Elliman Report: 2Q14 Manhattan Sales [Miller Samuel] Miller Samuel Aggregate Database [Miller Samuel] Market Chart Gallery [Miller Samuel]