If you’ve been:

A. Pouring over state maps of pet ownership

B. Watching the World Cup

C. Watching the Tour de France

D. Fretting about the Russell Stover purchase

Then you may have missed last week’s market report releases for Brooklyn, Queens and Westchester/Putnam Reports. These are part of the report series I’ve been writing for Douglas Elliman since 1994 (20 years!). The reports have a new look – hope you like them.

Click on graphics to open them.

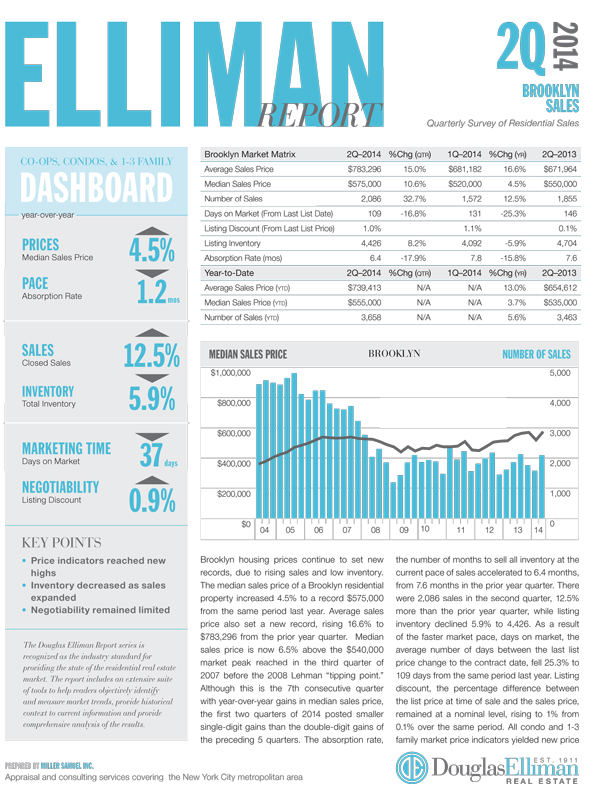

BROOKLYN SALES MARKET Brooklyn housing prices continue to set new

records, due to rising sales and low inventory.

The median sales price of a Brooklyn residential

property increased 4.5% to a record $575,000

from the same period last year. Average sales

price also set a new record, rising 16.6% to

$783,296 from the prior year quarter. Median

sales price is now 6.5% above the $540,000

market peak reached in the third quarter of

2007 before the 2008 Lehman “tipping point.” Although this is the 7th consecutive quarter

with year-over-year gains in median sales price,

the first two quarters of 2014 posted smaller

single-digit gains than the double-digit gains of

the preceding 5 quarters…

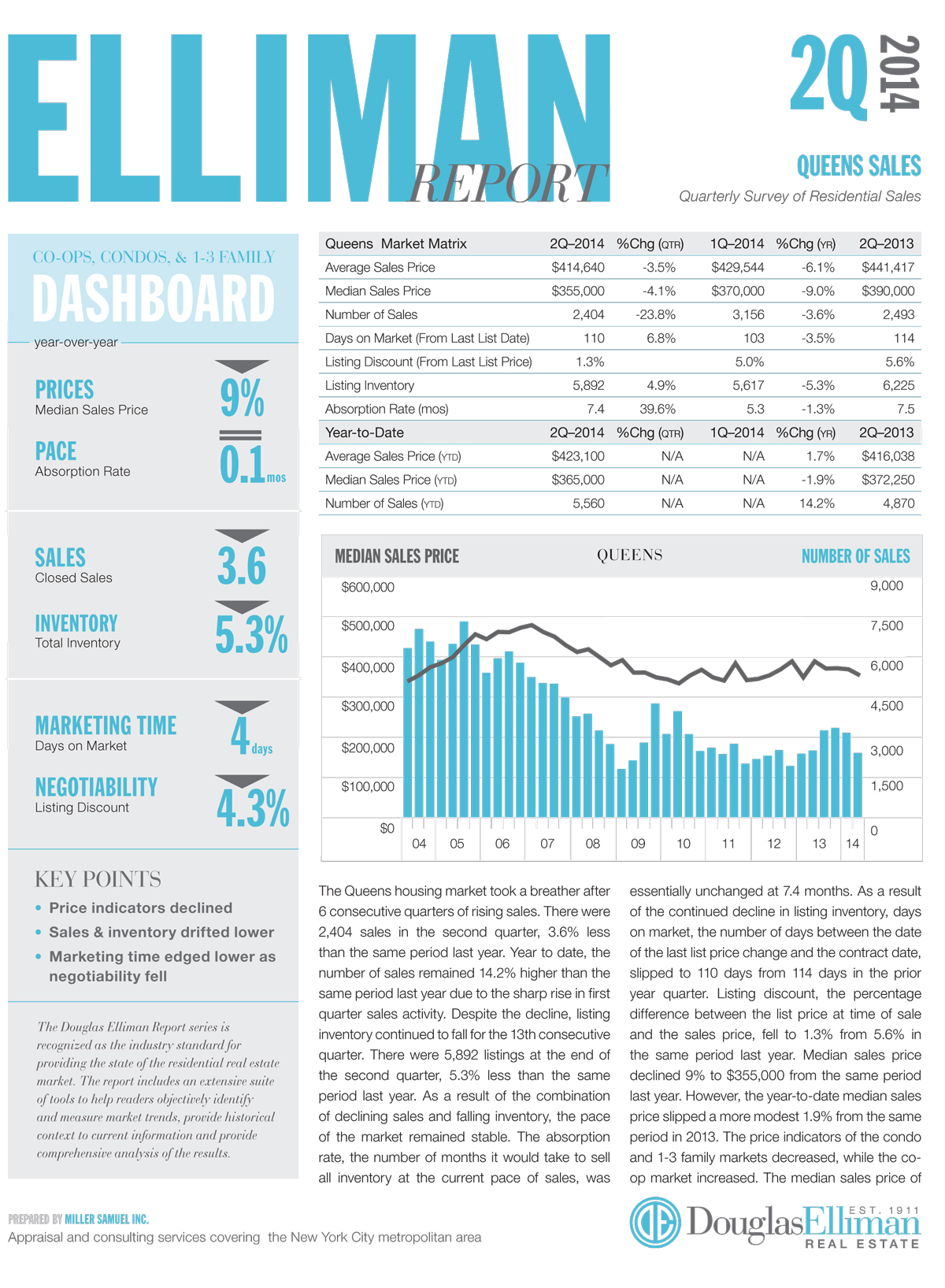

QUEENS SALES MARKET The Queens housing market took a breather after

6 consecutive quarters of rising sales. There were

2,404 sales in the second quarter, 3.6% less

than the same period last year. Year to date, the

number of sales remained 14.2% higher than the

same period last year due to the sharp rise in first

quarter sales activity. Despite the decline, listing

inventory continued to fall for the 13th consecutive

quarter. There were 5,892 listings at the end of

the second quarter, 5.3% less than the same

period last year. As a result of the combination

of declining sales and falling inventory, the pace

of the market remained stable…

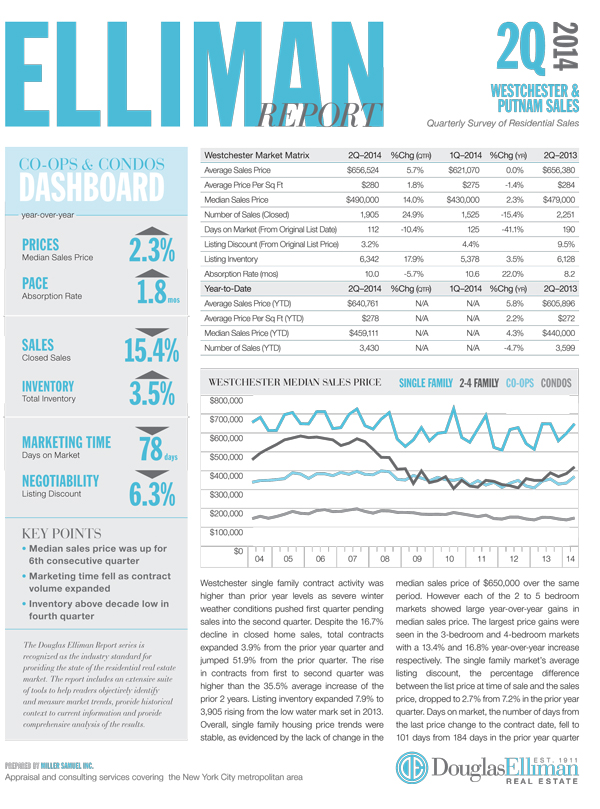

WESTCHESTER/PUTNAM SALES MARKET Westchester single family contract activity was

higher than prior year levels as severe winter

weather conditions pushed first quarter pending

sales into the second quarter. Despite the 16.7%

decline in closed home sales, total contracts

expanded 3.9% from the prior year quarter and

jumped 51.9% from the prior quarter. The rise

in contracts from first to second quarter was

higher than the 35.5% average increase of the

prior 2 years. Listing inventory expanded 7.9% to

3,905 rising from the low water mark set in 2013…

_________________

Miller Samuel Aggregate Database [Miller Samuel]

Market Chart Gallery [Miller Samuel]