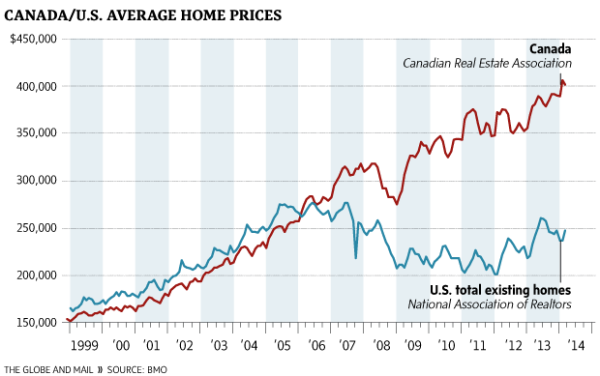

I was reading Tara Perkin’s piece in The Globe and Mail about the record price spread between the US and Canadian housing markets and saw one of the most startling housing charts of late (above). To be clear, this chart doesn’t adjust for the exchange rate but the article says the Canadian/US existing home price spread would be large – closer to 50% than 66% – still huge.

The article cites Bank of Montreal’s chief economist Doug Porter as saying:

“The main takeaway is that, contrary to all expectations, the Canadian housing market has just kept on rolling in 2014 even as the U.S. housing market has paused for breath (after a steep climb out of the dungeon),” he writes in a research note. “Put it this way, how many pundits a year ago were calling for Canadian home prices to rise faster than their U.S. counterparts in any single measure?”

Yes, true, but this is probably another good reason not to rely on anything published by a lender’s “chief economist” title due to their inherent bias toward the interests of their employer. What I find fascinating about the Canadian housing market is the proliferation of the false rationale that prices are being used as a measure of housing health. For the US counterpart, think Miami and Las Vegas circa 2005 when prices were skyrocketing and sales were falling.

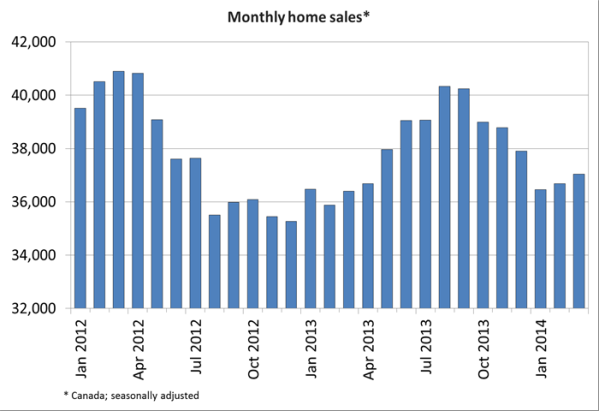

The Canadian government tightened credit conditions a year ago and sales fell sharply:

This time last year it was far from clear when and if the Canadian housing market would emerge from the sales slump that ensued after former Finance Minister Jim Flaherty tightened the country’s mortgage insurance rules.

Focus on March 2014 v. March 2012 in the following chart:

With Canadian home buyer’s access to credit now reigned in, sales fell sharply yet housing prices continued to rise. But Canadian housing prices are rising now much like they are in the US, based on restricted access to credit that keeps inventory off the market. And we’re not talking about household debt.

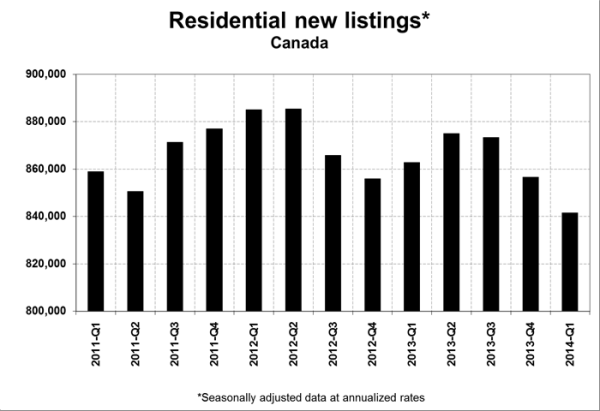

New housing inventory entering the market in Canada is now falling which is continuing to goose (sorry, Canadian geese pun) prices higher.

The Greater Fool Theory Applies to the Canadian Housing Market

A theory that states it is possible to make money by buying securities, whether overvalued or not, and later selling them at a profit because there will always be someone (a bigger or greater fool) who is willing to pay the higher price.

Of course from our past experience in the US, it’s not surprising to see every outpouring of Canadian housing market bubble concern met with an equal outpouring of Canadian housing bubble denial.

Please stop using housing prices as a measure of housing health. It was obviously flawed logic when applied in the US during 2003-2006 and now it has become apparent it was flawed during the 2012 to 2013 US run up.

Housing price growth doesn’t reflect good housing market health in Canada either.

5 Comments

Comments are closed.

[…] Jonathan Miller, a US real estate appraiser posted an article comparing the US and Canadian markets. […]

The Canadian market is complex in that the market has been socialized by government incentives and government administered high ratio mortgage insurance programs which has raised the base level of prices. Not because of the properties physical attributes but on the buyer’s financial ability to pay. At the other end of the spectrum, the market has become a reserve currency. Mostly in the luxury condominium market where some analyst have speculated that as much 25% of the condominiums that have been built in the last decade are vacant and mortgage free, allowing them to be traded on the world market as a form of reserve currency. A corrupt government official in some country may be easily bribed with a condo in Toronto or Vancouver.

The phrase used to be follow the money – now it’s follow the condo.

No evidence of significant foreign buying in Canada. The data just doesn’t support it. What has driven Canadian RE over the past decade has been an explosion of subprime credit availability through the CMHC.

What seems to be occurring at the moment in the GTA/GVR is a shift to the sales mix. Lower-end houses aren’t moving, while the high end mostly carries on as usual. Thus, the ‘average selling price’ appears to be higher, but that’s not to say that any individual property within this ‘sales mix” has actually appreciated.

Lagging indicators such as the Teranet numbers are now slowing/flattening, which is a sign that the price declines began approximately a year ago with the Budget 2013 changes at the CMHC.

Increasingly Realtors and other sell-side trolls have been spending a lot of time in the media and on various Internet forums and message boards claiming rising prices, which runs contrary to what most real life people without a conflict-of-interest, have been saying/experiencing.

You are right Mark there is no evidence of significant foreign buying in Canada.

However that’s because no one is collecting the data. The only evidence is anecdotal and through indirect sources. When the city planner for Vancouver states that 25% of the new condos are vacant, or the electric company reports that some 18,000 condos in the city are only consuming enough power to run a fridge, or the number of tax notices that are being sent to a different address than the assessed property. Or simply a walk down the street and looking up at the towers at night and seeing the number of units that are not lit.

But we do know that there is a lot of foreign capital flowing into the cities. The government does keep track of that. And that money flows into new condo projects by investors. Where the contractor is no longer in the business of selling condos but in the business of getting investors to pay for the construction. In that way he can continue to draw a paycheck even if none of the condos sell. That allows the developer to continue to build tower after tower and not worry about making bank payments. It’s the investor who takes the hit in the end.

Just like Henry Ford who built the first cars that his workers could afford. Its the same with the new condo developments they are building for the speculator/investor and by doing so creating jobs for the workers to buy into the project at the lower end. But when the jobs go – so do the workers’ condos.

And yes we have had a tremendous explosion in the high ratio insurance game. Where Canadian taxpayers were backing investors to buy condos with only 5% down. Where CMHC went from backing 200 billion in mortgages to close to 600 billion in five years. Only recently has the overseer of the financial industry begun to close these barn doors.

All of this comes down to “shadow” inventory. A large amount of vacant housing that can quickly come to market and destabilize prices. And anyone that has been in business knows when you have too much inventory or supply there is only one way to reduce it. And you want to make sure to sell your oversupply at today’s prices before your competition forces you to sell at tomorrows.

This guy is insane!