I’ll repeat that: Tight Credit Is Causing Housing Prices to Rise.

Yes I know. I’ll explain.

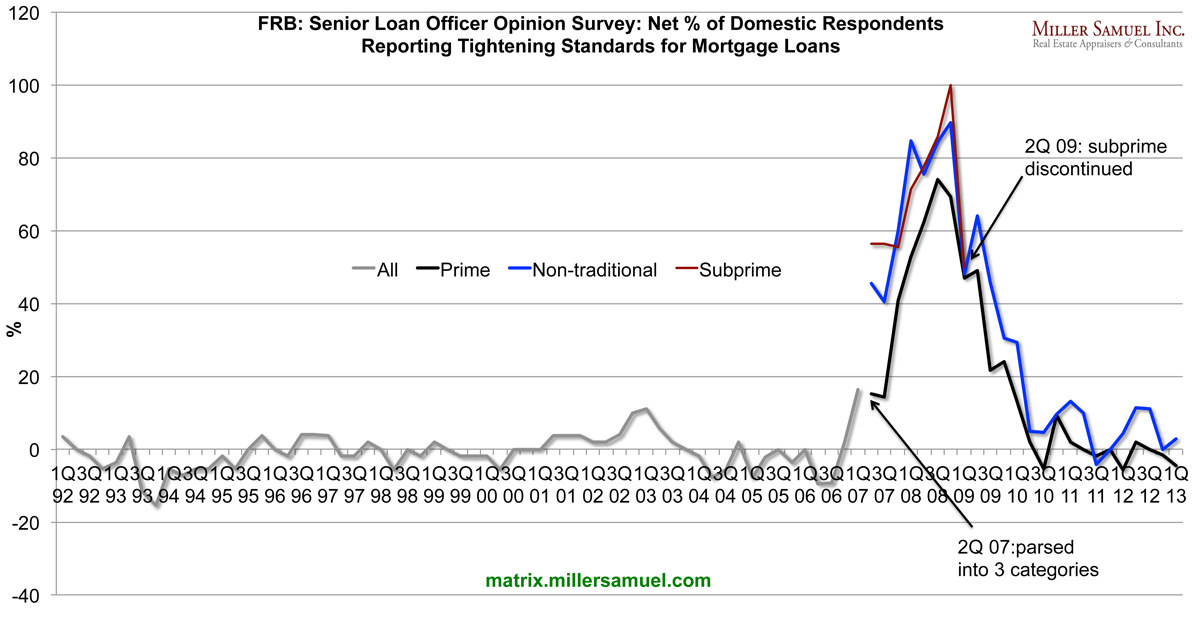

This week the Federal Reserve released it’s January 2013 Senior Loan Officer Opinion Survey on Bank Lending Practices and it continued to show little movement in mortgage underwriting standards but demand was up. The increase in demand has not softened mortgage lending standards. In fact, mortgage standards have remained essentially unchanged since Lehman collapsed in 2008.

On the household side, domestic banks reported that standards for both prime and nontraditional mortgages were essentially unchanged over the past three months. Respondents indicated that demand for prime residential mortgages increased, on net, while demand for nontraditional residential mortgages was unchanged.

Tight lending standards has prevented many sellers from listing their homes because they don’t qualify for the trade up, holding supply off the market. The shortage is manifesting itself by also keeping people unaffected by tight credit from listing until they find a home they wish to purchase. Record low mortgage rates keep the demand pressure on as affordability is at record highs. Rising prices are not really based on anything fundamental like employment and a robust economy.

Tight credit + record low mortgage rates => reduced supply + steady demand => rising prices.

Like I said before…

Tight Credit Is Causing Housing Prices to Rise.

I’ll repeat that….

Tight Credit Is Causing Housing Prices to Rise.

_________________

January 2013 Senior Loan Officer Opinion Survey on Bank Lending Practices [Federal Reserve] Falling Inventory Has Created a Housing “Pre-Covery,” not “Recovery” [Miller Samuel Matrix]

18 Comments

Comments are closed.

Good observation! I agree. I’m working up my forecasts for the AL Markets and reviewing last year’s have found more interesting correlations, hint it is not interest rates though 🙂 But I do agree that interest rates are impacting pricing. Perhaps more precisely due to the inflationary and inverse relationship between interest rates and pricing of financial assets.

Thanks Tom – looking forward to seeing your forecasts. It’s going to be a weird year I think. Weak in first half and more active in second half.

[…] Streeters use when ripping people off (Fortune) • Tight Credit Is Causing Housing Prices to Rise (Miller Samuel Inc.) • Predicting Markets, or Marketing Predictions (Advisor Perspectives) see also Perils of […]

This observation is erroneous at its core. As a 40 year lender and student of mortgage markets, I can assure you that lenders have been and continue to tighten underwriting standards. I do expect that tren will reverse in 2013 as more and more lenders return to mortgage originations.

The increase in value is due primarily to low interest rates and a dimunation of worries about job security on thbe part of 75% of potential buyers. The housing recovery has been dramatically dampenedd by credit standards tightened to catch the horses that left the barn between 2007 and 2009. At today’s housing price levels, the downside risk in pricing is minimal. The increase in demand has to do with buyers who feel that the economy has been wrung out, that inflation is on the way and they need to act now while rates and prices are low. The duration of this housing slump was exacerbated by the underwriting pendulum swing too far. I could not agree less with the conclusion that tighter credit standards are contributing to rising home prices. The exact opposite is true.

Hi George – Thanks for taking the time to comment on a post without reading it. Actually you were spamming – it’s always amazing to me that there are people out there that still think this is a good way to generate business.

Jonathan your insults are unwelcome. I am not spamming, not trying to get business from. Simply stated I find your locgic critically flawed.

To comment in an abrasive brushstroke tone like you did in the first sentence was insulting to me and then you followed it up with the second sentence means you either didn’t understand the purpose of the chart, the point being made or you were a spammer. I get a steady stream of this stuff so I am sorry if I mistook your aggressive tone for spam.

Incidentally, if you track interest rates for the past 6 years, they have dropped like a stone and housing prices have dropped as well. Your math doesn’t apply – perhaps in your local Ohio market it has recently.

I find it a little shallow and self indulgent for you to choose to assume that a commentor has not read the article. Jonathan the analysis presented does not include significant variables. Simply stated, overkill in tighter underwriting has indeed dampened and delayed the housing recovery. Ihave no idea whay you think me commenting on your post is spamming or an attempt at anything other than presenting a counterpoint to what I atronly beleive to be flawed reasoning. Just delete my comments if they trouble you so. Theis no reason for you to be insulting. By the way, don’t contact us, if we need a disagreeable appraiser, we will call you.

Of course I am being that way – this is a blog, my blog and an open forum for discussion. I welcome civil commentary so please rethink your approach when you enter for the first time to any site. Would you talk that way to someone you just met in person? And yes I am clearly disagreeable person so I would miss the opportunity to do an appraisal for your Ohio firm.

Let’s start over…

I agree that tight underwriting has slowed the recovery – lenders are still grappling with their legacy of bad lending decisions. That’s not the point being made in the post. The idea here is that 40% of mortgage holders have low or negative equity. Tight lending standards (better lender standards) are keeping many sellers from buying because they don’t qualify for the purchase so they don’t list. Low rates are enticing to them but they simply can’t list because they can’t buy. That’s the point being made. Tight credit is keeping inventory out of the market.

Tight credit => falling inventory => rising prices.

[…] – Tight Credit Is Causing Housing Prices To Rise (appraiser & analyst Jonathan Miller, Matrix) […]

[…] Tight Credit Is Causing Housing Prices to Rise | #MillerSamuel @jonathanmiller VT Reply With Quote […]

The same standards which apply to would-be sellers not being able to move up apply to would-be buyers. Your premise would be accurate if tighter credit standards affected more would-be sellers than would-be buyers.

I believe that prices are moving up because of supply inelasticity and that inelasticity is induced by would-be sellers having negative of little equity. No one wants to bring $75,00 to escrow to sell their home.

Thanks for the feedback Dick. Interesting point. Since the key driver of rising prices is falling inventory, it seems immaterial to me whether credit is tighter for buyers versus sellers. Your second paragraph basically says that. Supply is inelastic because credit is not easing.

Supply is inelastic not because of credit standards but because prices have not increased enough to bring more sellers to market. This (little or negative equity) has created the low inventory. If my notion is correct, we should see flat prices once there are few underwater sellers.

Understood – but my point is that 40% of mortgage holders have low or negative equity so they CAN’T list their property for sale and then become buyers. Yes there are people sitting around waiting to see what the herd will do, but an alarming number of people have no choice and THAT’s why inventory is falling so rapidly.

[…] while the cause of this price increase may seem elusive in the current economy, a recent article by Jonathan Miller of Miller Samuel, Inc. suggests that it is in fact the tight credit market that […]

[…] while the cause of this price increase may seem elusive in the current economy, a recent article by Jonathan Miller of Miller Samuel, Inc. suggests that it is in fact the tight credit market that […]

[…] where home appreciation was fueled by loose underwriting. It’s actually the opposite, where tight underwriting plus low rates push home inventory down and prices up. And right now loan underwriting is as tight as it gets, leading to the loan quality stats noted […]