Trulia released its Price Reduction Report for February 2010 and press release

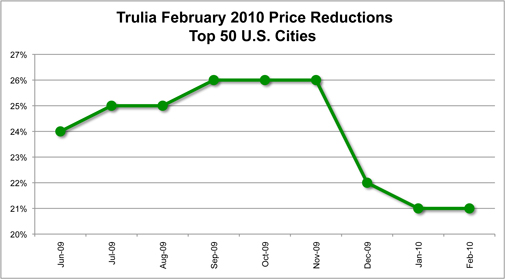

After several years of significant price reductions, the amount of the deductions have been showing a decline. However, since there isn’t seasonal data to trend (the series started in mid-2009), we can only use this to confirm what we have already observed. California was one of the first market areas to see sharp price decline so sellers don’t have much more distance to travel to reach market and therefore they are at the bottom of the list. The months before the expiration of the tax credit program saw a rise in the amount of seller price declines. The subsequent renewal saw a sharp reversal of the pattern.

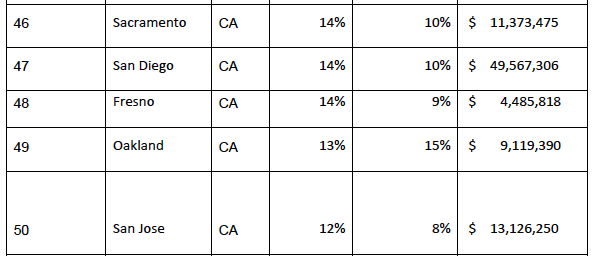

>Major Metros in California Experience Biggest Decreases in Home Price Reductions

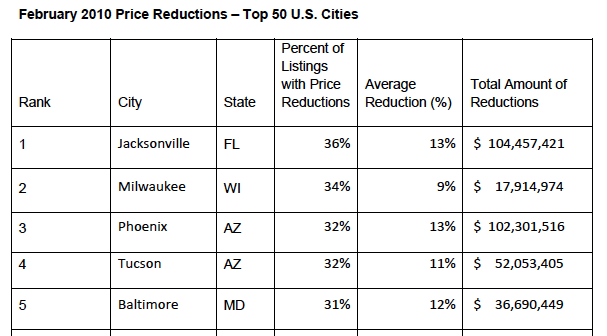

SAN FRANCISCO February 16, 2010 – Trulia.com (www.trulia.com), smart real estate search to help you make better decisions, today announced that 21 percent of homes currently on the market in the United States as of February 1, 2010 have experienced at least one price cut. This represents the second straight month of home price reductions at this level, the lowest level since Trulia started tracking price reductions in April 2009, and a significant decrease since November 2009, when 26 percent of homes had at least one price reduction. The total dollar amount slashed from home prices dropped to $22.6 billion compared to $28.1 billion in November, a 19 percent decrease. The average discount for price-reduced homes continues to hold at 11 percent off of the original listing price.

California Seeing Less Reductions

>Of the top 50 major U.S. cities*, only seven had price reduction levels at 30 percent or higher in February 2010, down from 21 in November 2009. Eight cities have seen a decline by more than one-third, and five of those cities are from the state of California: San Francisco, Oakland, Sacramento, San Jose, and San Diego.

Tax Credit is Skewing Seller Behavior

>The trend, in fact, is pretty clear – it’s what to make of it that’s the question. The months leading up to the pending expiration of the home buyer tax credit last fall saw a rising trend line of price reductions, here and across the country.