There was a great article in the New York Times today that provided some logic as to [why Katrina could extend the housing boom further](http://www.nytimes.com/2005/09/05/business/05build.html?pagewanted=print).

[There have been signs lately that the intensity of the housing boom was waning as outlined in a WSJ story [Note: Paid Sub.]](http://online.wsj.com/article/0,,SB112562153717629767,00.html) or could it simply be because its August? 😉 [The shortage of building supplies](http://matrix.millersamuelv2.wpenginepowered.com/?p=99) and rising fuel prices as a result of the storm are thought to temper the economy, dragging down long term rates as inflation threats are diluted. The outlying areas around the devastated region are already [seeing a surge is rental demand](http://matrix.millersamuelv2.wpenginepowered.com/?p=98) as people were displaced from their homes.

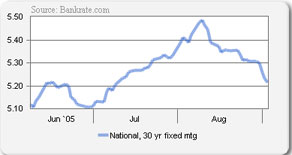

We can already see a damper in mortgage rates, which dropped sharply last week.

[In another good article in last week’s New York Daily News [no, not because I was in it]](http://www.nydailynews.com/09-02-2005/front/v-pfriendly/story/342793p-292538c.html) that provided similar logic. Higher costs are keeping a damper on inflation, which keeps long-term mortgage rates low.

What I find so fascinating about all this is how different the economy is today as compared to the last oil crises in the early 70’s. Bond investors see a slowing economy as the answer to keeping inflation in check. Corporations are forced to absorb much of the higher operating costs that come along with rising fuel and material costs due to foreign competition. That in turn keeps a reign on hiring and payroll.

There is already speculation that the Fed will not raise short-term rates in their next session due to concern that the economy could slip back into a recession.

And the housing market keeps going…

3 Comments

Comments are closed.

I am curious – do you think that there will be a great need for appraisers in these areas? or will homes be built by the government to replace those lost and deeded without an appraisal. Even if that does happen I would think there would be alot of refinancing and selling going on after the property was transfered to the new owners.

Once again, this is a gut reaction link to a gut reaction article. The argument that they propose is pretty flimsy and is really localized to the gulf region. It has nothing to do with both coasts, where prices are beyond reason and buyers are still sitting out. With the price of oil continuing to be high, potential buyers (particularly non-investor types and first timers) get one more reminder that they should rein in their overall spending, including real estate.

Anonymous makes an interesting “non-flimsy” point. However, the argument not limited to the coast since mortgage rates are fairly similar on a national basis. Buyers are not sitting out yet (nationwide) since volume is still relatively high. First time investors that are getting priced out will move over to rentals which is seeing a modest uptick for the first time in 4 years.