One of the things we have discussed on Matrix before is the fact that housing sales are translated into “home renters equivalent” which is a significant portion of CPI (40%).

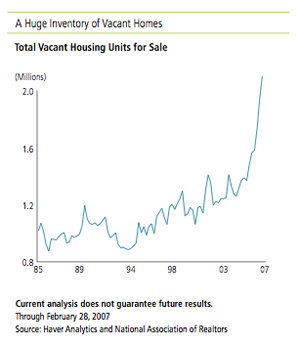

Our AXA advisors passed along the AllianceBernstein Investments Q1 2007 Capital Markets Outlook and it provided an interesting outlook on rising housing vacancy and its downward influence on inflation and mortgage rates.

In short, AB is saying that rising vacancies will drive down rental rates and since housing rentals comprises 40% of core inflation, CPI is expected to drop to 1.5% later this year forcing the fed to lower rates, leading to lower mortgage rates.

In other words, the slow down in housing has not fully impacted the economy.

7 Comments

Comments are closed.

It seems a bit of a stretch to suggest that rising housing vacancies will cause the CPI to change… The report states that millions of new homes were built during the housing boom and suggests that since these are now vacant, many will soon become rentals. However, what percentage of those new homes can really be converted to rental property. I doubt that a surge in rentals of higher end homes in the suburbs will have a huge impact on home rental prices in more urban areas. There are only so many people willing to pay thousands of dollars every month to rent (especially if it means a longer commute). It seems more likely that foreclosures will surge.

I wrote about this a week ago, “Inflation & Condo Conversions”:

OER (Owner equivalent rents) and rental prices surveyed by 50,000 landlords make about a significant portion of the CPI data. Unfortunately, the anticipated trend of condo conversions to rentals bringing down rental rates and moderating CPI data only strengthens the argument that the government dataset is flawed and is NOT showing the true picture of inflation in the the US.

It’s a bad thing that could come back to reveal itself at a later time.

Not the first time that arguments are made that inflation is much worse than is being reported by the numbers.

As for mortgage rates, using this theory for predicting short term trend in lending rates is inefficient. Rather, follow the bond market and specifically the 10YR note yield trend for a more accurate prediction of where short term lending rates are headed.

When the US jobs report came out so strong, it was obvious that the US economy is still very strong and moderating cpi # was discounted due to its flaws that the street is aware of. That is why bond yields surged and lending rates rose soon after.

Fed easing is still not a slam dunk.

I agree about the slam dunk part.

Excellent information. Your analysis on the rent equivalent is right on. The core will come down, as it should, and the Fed will lower rates, as it should. I side with Art Laffer in that the Fed follows the market (the 3 mo. treasury) and that will entail at least two cuts by Q4. Or you can arrive at this also by subtracting Q1 nominal GDP by the Fed Funds rate and you see we have overly restrictive policy by at least 70 basis points now, not accounting for further lag and slowdown. So I’m in for at least two, hopefully three rate cuts.

Overly restrictive policy? You really think so? We are at 5.25%? Historically, this is NOT restrictive and is much more in the neutral area as opposed to restrictive or stimulative.

Where is the US economic weakness if equity markets are at record highs? I have never seen the fed ease when equities are at record highs and inflation worries still persist.

Lets not forget, a year ago EVERYONE was joining the media in the camp that early 2007 would bring at least 2-3 rate cuts! We’ll its almost June and the fed still has a BIAS towards fighting inflation!

No way they cut until they publicly warn the markets of their near term intentions.

Noah, the current economic stats are bearing the full brunt of the weakness in other markets. Economists and pundits who seem to be bullish are generally from this area, making me wonder. I was just in Chicago and I observed a tremendous amount of development with signs offering free cars with your condo purchase. Take a look at this article: http://www.bloomberg.com/apps/news?pid=20601039&sid=aXAVW8DrSnCs&refer=columnist_baum

Thx JM, good read. I just think the world today is so much different than the world 5 years ago. Fundamentals leading to the world today include globalization, liquidity, low interest rates, management/structural changes since dot com collapse, huge corporate share buybacks inflating future earnings per share, etc..

I worry that an unforseen will eventually hit us as economists say, ‘I didnt see that coming’. Fact is, very few have been in such a complex global economy as we are in right now. Will inflation on a global level cause rates to rise much further? Will Chinese equity markets collapse after unsustainable growth? Will leveraged buyouts fail? Will there be a credit crunch? Side effects of all this liquidity? Hedge Fund regulation to disrupt US equity markets? A democratic congress or president to make business investments less tax friendly?

So many questions. So few answers. Like you say in Chicago, I was on LI last week and I cant begin to tell you how many FOR SALE signs there were. I go out there at least twice a month and grew up there. Never before have I seen such a supply of homes.

I think the world we are in goes way beyond housing, and to get a grip on what might happen to housing or rates, we have to look elsewhere.