Damon Darlin’s [The Last Stand of the 6-Percenters? [NYT]](http://www.nytimes.com/2006/09/03/business/yourmoney/03real.html?ei=5070&en=afb381f38b8a869a&ex=1157428800&pagewanted=all) was a really great overview of new brokerage services that are being offered. The article was very informative. However, after reading it, the article made me wonder _who on earth would ever use a traditional broker again?_ Its not what I think the intention of the piece was.

New technology and new business models were pitted against longstanding tradition and a proven track record. There was a great phrase in the article referring to the difficulty of innovation in the real estate brokerage industry:

_It’s a thousand tiny shackles on innovation._

A valid point. Innovation can ruffle feathers.

Well, rather than the idea that full service brokers are obsolete, I think the takeaway should be that there is room for both the old and the new. Like [Dottie Herman, CEO of Prudential Douglas Elliman](http://www.prudentialelliman.com/MainSite/Company/DottieHerman.aspx) (the firm for whom I author their [market reports](https://millersamuel.com/reports/) for) said at Inman San Francisco: _[Technology won’t replace agents, agents with technology will replace agents [RCG]](http://www.raincityguide.com/2006/09/02/i-am-tiger-woods/)_. Exactly.

The irony in all this is the fact that the housing boom coincided with new venture capital monies which provided the opportunity for so many real estate start-ups to in fact, _start-up_. In fact, I see this as more of a _dotcom real estate boom_, with so many legitimate business models, rather than most of the silliness we saw in the previous dotcom boom, where thoughts of actually turning a profit would be figured out later.

Some of these new real estate technology sites will fail as the housing markets cool or their idea doesn’t catch on, while others will survive and thrive. Change can be good but its kind of hard when the system in place has been around for a long time.

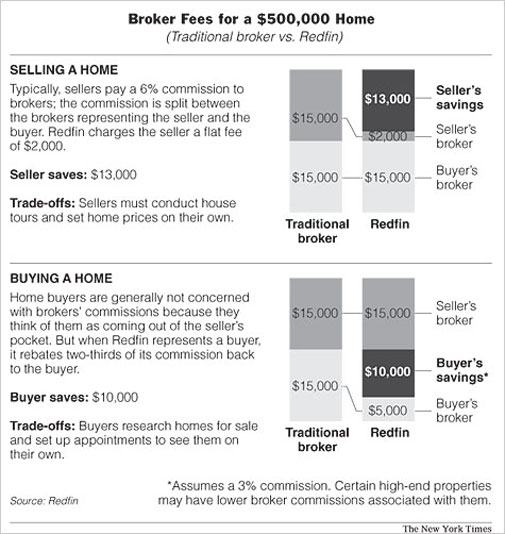

I find that one of the weaker arguments to the new real estate models has been the idea of cost savings. Despite the near monopoly of listings through traditional MLS systems, there is the assumption that its an even playing field. In other words, users of these discount brokers assume that the property gets exposed equally whether its a [Foxtons listing (remember Your Homes Direct?)](http://www.foxtons.com/), a [Redfin listing](http://www.redfin.com/stingray/do/home?rt=tn-hb) or a full service listing, when in fact, I would speculate that it does not.

More eyeballs on a property, especially broker eyeballs, yield a higher chance for a higher price or simply a sale. In other words, a seller may be saving costs, but they could be working off a lower base (sales price) number because of the lower exposure. The cost savings seems to be more of a potential future benefit than at present and its not really comparing apples with apples (in theory it is, but not in practice). The MLS system is proprietary.

And what is it with [NAR and public relations](http://narblog1.realtors.org/mvtype/narinthenews/)? How can the NAR stir such ill will on a consistent basis? I continue to be amazed by their complacency and their disconnect with the public as an organization. Its tough to accept their word as gospel anymore. Even their current radio and TV ads about code of ethics seems to be too little too late. Its simply not fair to most realtors who are nice normal people and not the stereotype the profession has gained a rep for in recent years.

As a result, if you want to create a new real estate brokerage business model, now seems to be as good a time as ever.

3 Comments

Comments are closed.

(Technology won’t replace agents, agents with technology will replace agents [RCG]. Exactly.)

Exactly right. What the six percent tradition did was vastly increase the money received for selling each house. That attracted more people to the field, pulling down the number of houses sold per agent, leaving each with about as much money as they would have had anyway.

Technology will eliminate some work (fewer people spending time looking at houses they have no interest in), computerize some work, and allow sellers to all, some, or none of the work. Lower costs will lead to fewer agents, not less money per agent.

The shakeout will be difficult, the winners will do well.

I sell real estate now, but I was in the business of design and Web development for years. There is a old saying and a glib truth in selling and buying design services: “you can have it good, cheap and fast; but you can only get any two of those at a time.” I think that applies across many industries including real estate services.

There is certainly evidence that technology can change things. The ability for it to dis-intermediate an industry, as the expedia/zillow guys did to travel agencies, is possible, but also quite rare. I’d ask you if the customer has actually benefited from it? Are air fares significantly cheaper because of it? I haven’t noticed; and it now costs my time to find the best fare and route. Discount on-line stock brokers did not put the full service ones out of business. The smart ones that offer real knowledge and guidance are still around. Amazon did not kill Wallmart, Ebay has not replaced Christies, and Yahoo did not see Google coming. There is room in the market place for multiple business models. The perception of value is what’s important.

The big lie in all of this is that people are led to believe that they are getting the same services for less. What’s missing from the Redfin service proposition is any claim that they will work to get a seller the highest price possible. That’s what brokers actually do. Their model is based around doing it cheaper not better; and you generally get what you pay for.

The caricature of the overpaid, lazy real estate broker is spin that serves Redfin and others who would like us to believe it. Like the title of your post implies Jonathan, as an industry, full service practitioners and the NAR could probably do a better job at communicating. Adding value for our clients through technology is something that my brokerage, The Corcoran Group, has created a legendary online business with, including a high standard of personal service. Innovation is not the particular domain of any one player. In NYC real estate brokerage is an industry largely filled with smart and highly motivated people. Competition fuels change. Articles like Damon Darlin’s serve as great reminders that there are those out there who’d like to eat my lunch. It’s far from a done deal.

We are working on a post on the future broker you might enjoy.