[UPDATE: The impact of the tax bill changed after it came out of committee and became law on December 22nd, 2017. See an updated tax law impact summary here.]

Both houses of Congress have passed far-reaching tax bills with a lot of common ground between them. The U.S. Senate and U.S. House of Representatives are in the process of merging their versions into a single bill that will be voted on, and if it gets out of committee, it will be submitted to the president for signing.

Unlike the 1986 tax reform bill, which took six months of public hearings and discussion on both sides of the aisle, this tax bill was worked on for a year by the GOP and was passed very quickly without most of the signers knowing what was actually in it. Therefore I anticipate an ongoing procession of additional insights that impact the housing market as more people read the bills or the eventual law.

This lack of transparency and vetting alone is not great news for housing, which is very dependant on an “uncertainty-free” environment. In addition, there is a “get it done before Christmas” deadline.

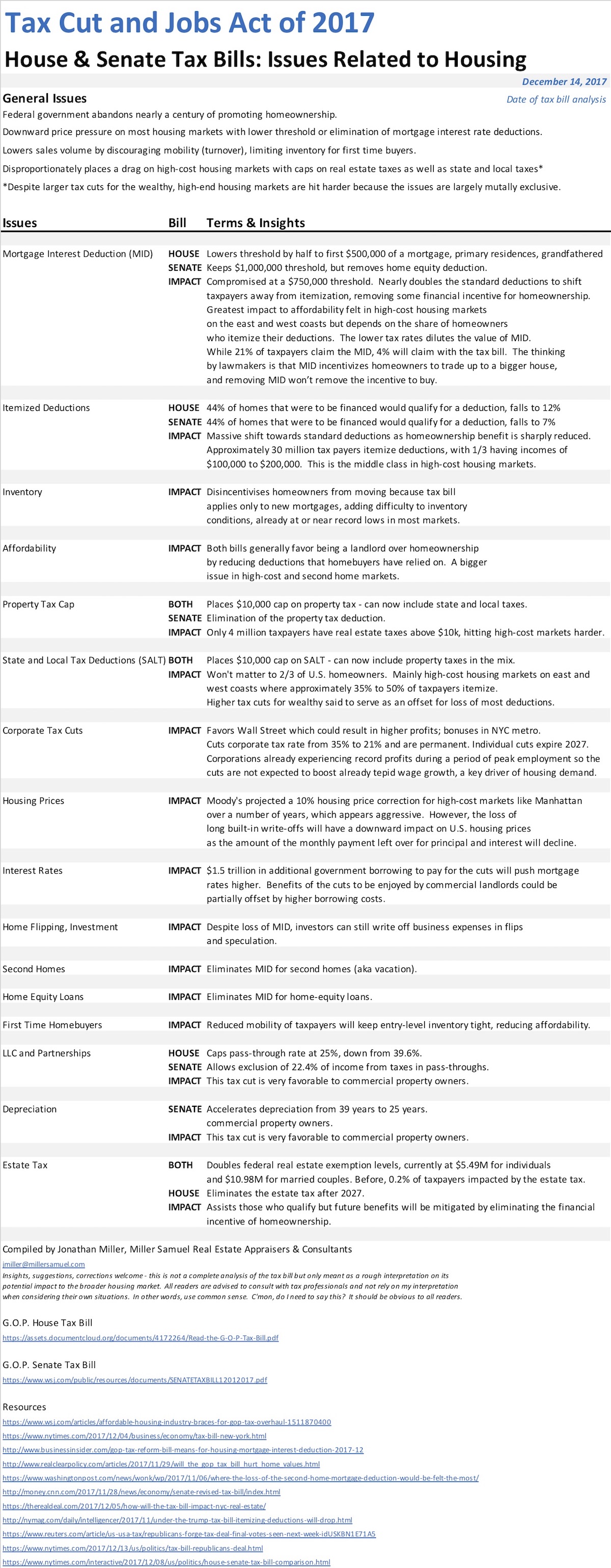

Here is what I mapped out but this is only what we think we know by reading many interpretations with source links presented at the bottom of the table below. Here’s the pdf version of the table.

Comments are closed.