source: GS Investment Strategy Group

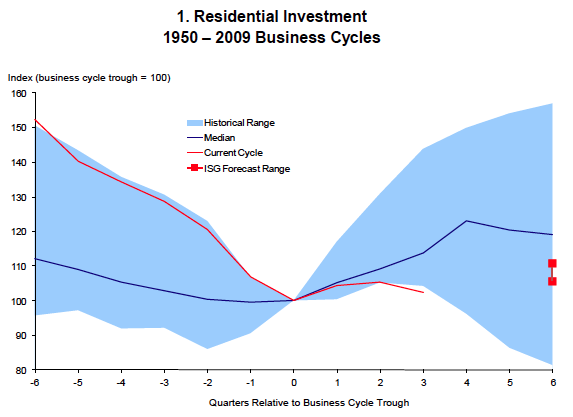

Current improvement seems to be on the low end of the range…but it’s not clear to me how this occurs at meaningful levels until excess supply is cleared.

From their Investment Strategy Group

The key changes to our 2010 outlook are as follows:

* We believe the Fed is unlikely to raise rates this year due to uncertainty around Europe and lower inflation data.

* We are lowering our 10-year yield forecast from 4.25-4.75% to 3.5-4.0%.

* As inflation has surprised to the downside, we are lowering our core CPI range to 0.75-1.25% from 1.0-1.5% and our headline CPI range to 1.5-2.0% from 1.75-2.25%.

* We maintain our central case target of 1150-1225 on the S&P 500

In 2011:

* We expect GDP to grow 2.75-3.25%. Investment will likely recover from its low levels; consumption should continue to grow at a moderate pace.

* The Fed is unlikely to raise rates until some time in the second half of 2011 unless employment growth and/or inflation surprise to the upside.

* Our central case target for the S&P 500 is 1225-1300

download report [GS Investment Strategy Group]