[NPR]

[NPR]

Well, it has been an odd couple of weeks brought to you by the global pandemic known as COVID-19 or the Coronavirus. We’ve been self-quarantined in our house for 1.5 weeks with many more weeks to go. I might have to refer to this pandemic as “Cabin Fever” although there are many people that don’t have the benefit of working at home, including one of my sons, who is a police officer.

With falling mortgage rates of the past year or so, many in the real estate community thought:

“oh my goodness, refi’s and housing sales are going to boom with these low rates, and any Fed rate cuts will offset the damage of a plunging stock market and the economic damage of a pandemic.”

But please remember this:

Falling mortgage rates are not a gift.

Rates are cut to stimulate the economy, to offset something terrible that has happened.

Rates have been falling for the past year as the Federal Reserve likely increased rates in the recent past to be able to have something to cut when the inevitable recession arrives. Because of the damage to the U.S. economy from the trade war, the Fed has been forced to act earlier to keep the economy from dropping into a recession.

Since March began, the Federal Reserve brought the federal funds rate down to zero in the first half of March with two massive cuts. With the first cut of 0.5% on March 3, consumers became fully aware that something significant was wrong, and it was associated with the Coronavirus (and oil prices). And surprising to many, national 30-year mortgage rates rose.

Mortgage lenders continue to enjoy the large spread instead of lowering mortgage rates substantially because of layoff decisions made over the past year as refi volume cooled. Most banks cannot take full advantage of the rate cut opportunity because they do not have the capacity.

Since the 2020 DJIA peak of February 12, 2020, of 29,551.42, the market has fallen 28.13% to 21,237.88 as of the late afternoon, an insanely large decline.

However, all of these housing-related workers such as appraisers and agents, are starting to see that market conditions do not include the gift that it will be “business as usual.” They and their colleagues are becoming fearful of their own personal safety and the safety of their families.

In light of this slowdown, some real estate agents have suggested that market times be modified to cast a better light on listings that will languish due to the virus. This type of action is precisely what should not be done. In a global pandemic or worldwide catastrophic event, housing market stats will be internally adjusted by consumers to factor the event into the equation. Cherry-picking stat solutions will breed distrust between agents and consumers.

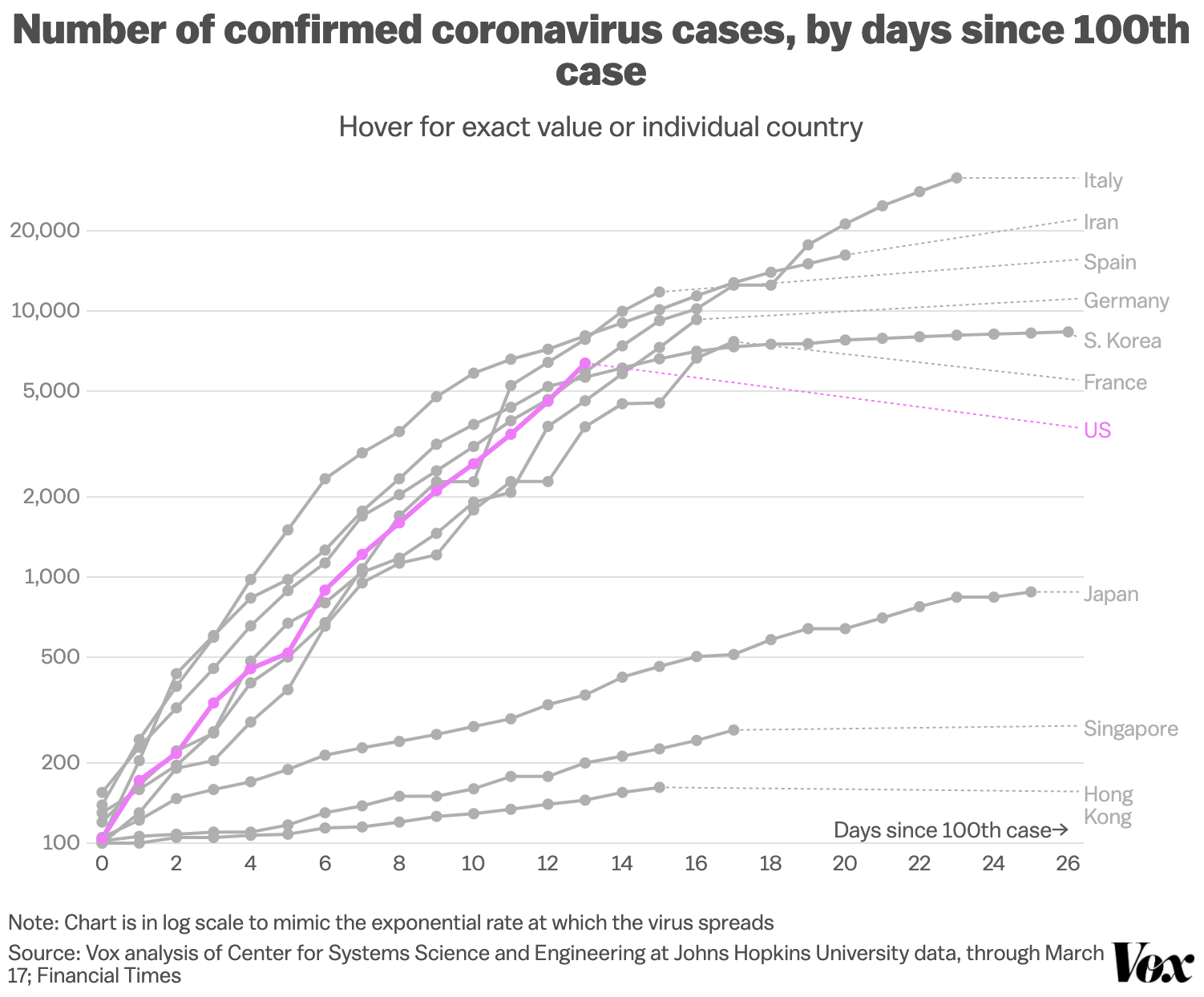

Open houses as a marketing tool fell 38% in Manhattan which is quite astounding but shows how quickly “personal safety” is becoming front and center with both agents and market participants. The outbreak is clearly expanding.

But now, those real estate agents are seeing home sellers and home buyers change their minds about letting strangers walk through their homes all day, and the “nexus between fear and greed” has shifted to fear.

Therefore the spring market will likely be underwhelming in NYC if downright bad and pushed forward into the future with a possible release of pent-up demand at some unknown future date. Perhaps the same will apply to many regions across the U.S. this spring.

Now wash your hands.

Comments are closed.