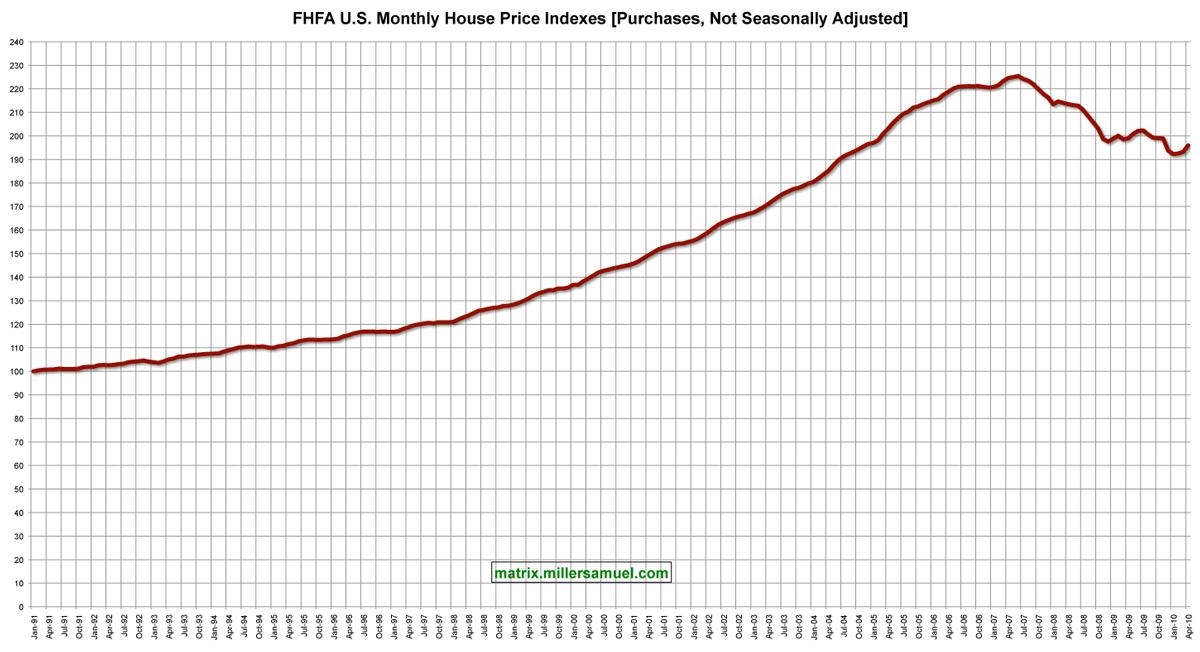

FHFA, the oversight agency for Fannie Mae and Freddie Mac, released their monthly US Housing Price Index for April. The index shows some stabilization since January however, April is the last month of the federal tax credit for first time buyers and existing homeowners so it would be reasonable to expect declines over the next 2-3 months.

>U.S. house prices rose 0.8 percent on a seasonally adjusted basis

from March to April, according to the Federal Housing Finance Agency’s monthly House

Price Index. The previously reported 0.3 percent increase in March was revised to a 0.1

percent increase. For the 12 months ending in April, U.S. prices fell 1.5 percent. The U.S.

index is 12.8 percent below its April 2007 peak.

Index Background

The index lags NAR’s Existing Home Sale by one month but it is a repeat sales index rather than an aggregate report. The index tracks Fannie and Freddie purchases mortgages where they acquire the paper or provide a guaranty, which dominates the mortgage business and provides the standardization that the secondary mortgage market relies on. This promotes liquidity of the US mortgage market but is limited to conforming mortgages of $417,000 in most of the country and $729,750 in designated high priced housing markets like the NYC metro area.

As a result of its data source, this repeat sales index is NOT a proxy for the US Housing market because it is skewed toward the sub-million housing market, roughly 80% of the US housing stock but is performing much better than the remainder because of the standardization provided by the former GSEs (Fannie and Freddie) and the backing of the federal government. Still, it represents the majority of the US housing market and warrants observation.

Since I am wary of seasonal adjustments my chart tracks the non-seasonally adjusted index, even though the press release relies on seasonal adjustments – the trend is the same but the month over months vary somewhat.

[click to expand

[click to expand