When I heard the latest NAR existing home sale stats released today, I fought back the urge to ignore them because of the past spin of David Lereah and the fact there is no national housing market, blah, blah, blah.

>Lawrence Yun, NAR chief economist, said home prices continue to fall significantly. “It appears some buyers are taking advantage of much lower home prices,” he said. “The higher monthly sales gain and falling inventory are steps in the right direction, but the market is still far from normal balanced conditions. Buyers will continue to have an edge over sellers for the foreseeable future.”

Here’s type of coverage on the news release today, which was consistent:

>The number of existing homes sold in December rose 6.5% from the previous month, according to a report released Monday, as bargain hunters took advantage of plummeting prices.

>The National Association of Realtors said that home sales increased to a seasonally-adjusted, annualized rate of 4.74 million units. That’s up from a revised pace of 4.45 million units sold in November and more than the rate of 4.4 million units projected by a consensus of industry analysts as reported by Briefing.com.

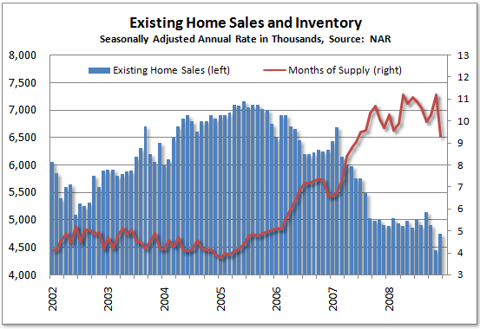

Tim Iacono, a regular contributor to Seeking Alpha, made a great chart trending number of sales and inventory (above). When you read the news coverage and press releases, you don’t get the perspective this chart provides:

* The number of sales are less than half of those in 2005 (blue line).

* The credit crunch that began in the summer of 2007 initiated a new low level of activity, has been remarkably level.

* The positive news of the 6.5% monthly uptick in the number of sales, in the context of post-summer 2007 credit crunch, suggests we may be moving into a lower level of activity.

* Without the surge in west coast foreclosure sales, the levels would likely be far lower.

In other words, this is so not over.

4 Comments

Comments are closed.

Definitely not over.

I track these things on an ultra-micro level in the zip codes, neighborhoods and even individual buildings that I pay attention to here in Los Angeles. My research and first-hand experience showed that there definitely were some areas that saw a mini-surge of sales in December. In some of those areas, the surge has continued in January. In some it hasn’t.

Just a blip? Probably. But when the patient appears to be flatlining, even a blip makes you feel a little better about the patient’s condition.

Not even close to being over. It looks like we can’t even print enough money to get this thing to even start looking like it’s coming to an end.

Must wonder if NAR exists to harbor the delirious.

Oops. Wrong “there.” Hard to edit on this little panel.