This year is the tenth anniversary of the Coen brothers’ The Big Lebowski about an LA slacker named “Dude”.

>Maude Lebowski: What do you do for recreation?

>The Dude: Oh, the usual. I bowl. Drive around. The occasional acid flashback.

I’m not suggesting that the unprecedented events in the financial industry over the weekend were “Dude-like”. However, it does show how the regulatory structure was manned by “slackers” while the industry pissed on the carpet (sorry, but a fundamental movie reference).

I was at a meeting last week, and a senior mortgage type person was basically suggesting that the credit crunch was nearly over now that the GSEs were taken over and all should be resolved by the end of the year. I piped in that we have a long way to go – nothing concerning fixing the credit markets had been resolved by the GSE bailout, but it was an important step at coming clean, in order to restore confidence in the financial markets.

The activities of this weekend showed this assessment to be accurate. There is a lot of unwinding to do before credit, and ultimately housing can get back on track.

While it is interesting that Frannie now serves one master (hint: the taxpayer) and may go easier on those entering foreclosure than the GSEs could or did, the pipeline is already flowing with foreclosures.

Foreclosures represent 0.6% of all US properties. This doesn’t sound like a lot until you realize this number hasn’t been reached since the Great Depression. I am not suggesting we are going into another Great Depression, but rather the scope of this financial crisis is not modest (Dude translation: far out, like it’s huge).

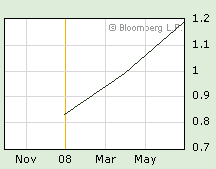

Foreclosures represent 1.2% of all mortgages. Here’s a chart from Bloomberg about the market share of foreclosures for properties with mortgages. This is twice the total ratio of all housing and the amount is significant.

And more importantly…

>That rug really tied the room together.

7 Comments

Comments are closed.

“Yeah, well, you know that’s just, like uh …your opinion, man.”

“… the regulatory structure was manned by “slackers” while the industry pissed on the carpet … That rug really tied the room together.”

Unfortunately, the American taxpayer is the carpet absorbing all that urine and it will take years to remove the stains. Guard dogs were trained not to guard by dog trainers aligned with the industry pissing on the carpet.

I got the impression it was “policy” to not regulate the economy of the US and the regulators were just following instructions. Therefore, the evidence is that it was regulation that was lax rather than the individual regulators being slackards. Seems “special” interests function better in the dark. Could it be that our leaders once again somehow missed the train?

Anybody want to talk libertarian politics as applied to money changers in the face of this phenomenon we are experiencing? As I see it, this is what we get with market disciplined players in the money changer sector. I suggest we let market forces take one more step and refuse any further government intervention until these parasites are begging to join the majority of humanity that is living paycheck to paycheck or worse, which is exactly the same folk being required to bail this mess out. Maybe the maggots will be able to find a job at Walmart or McDonald’s that hasn’t been outsourced yet

He thinks the carpet pissers did this?

Mulligan!

Jim@#4 Says:

“He thinks the carpet pissers did this?”

Oh? … Right, it’s the carpet’s fault.

Jim@#4 Says:

“He thinks the carpet pissers did this?”

Who better to blame? Human nature? Adam & Eve? The Devil?

Far as I can tell them identified heretofore as carpet-pissers are to blame.