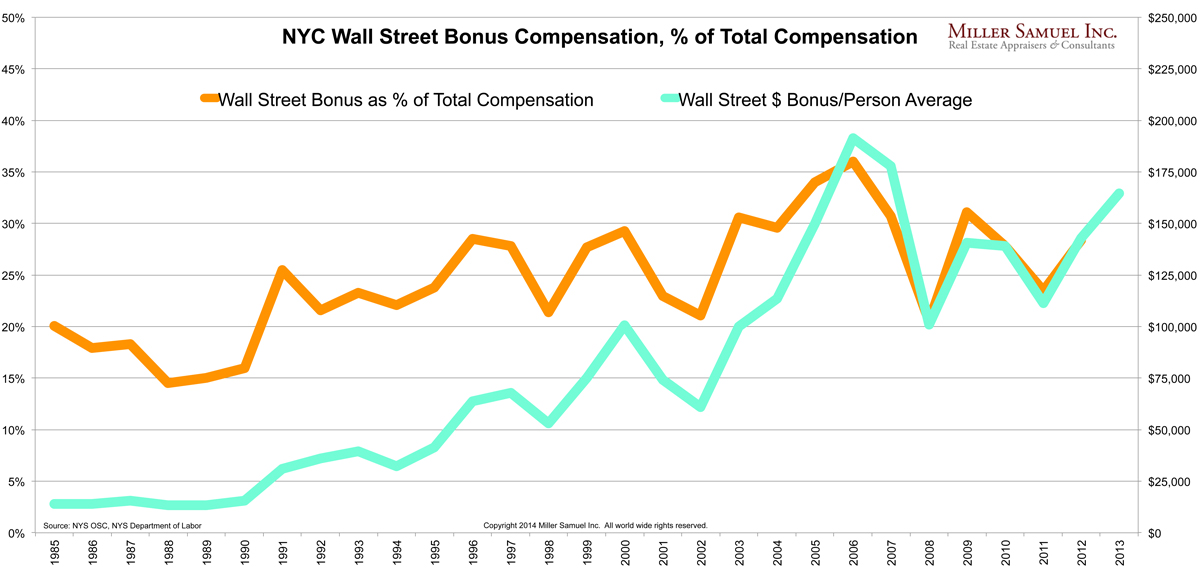

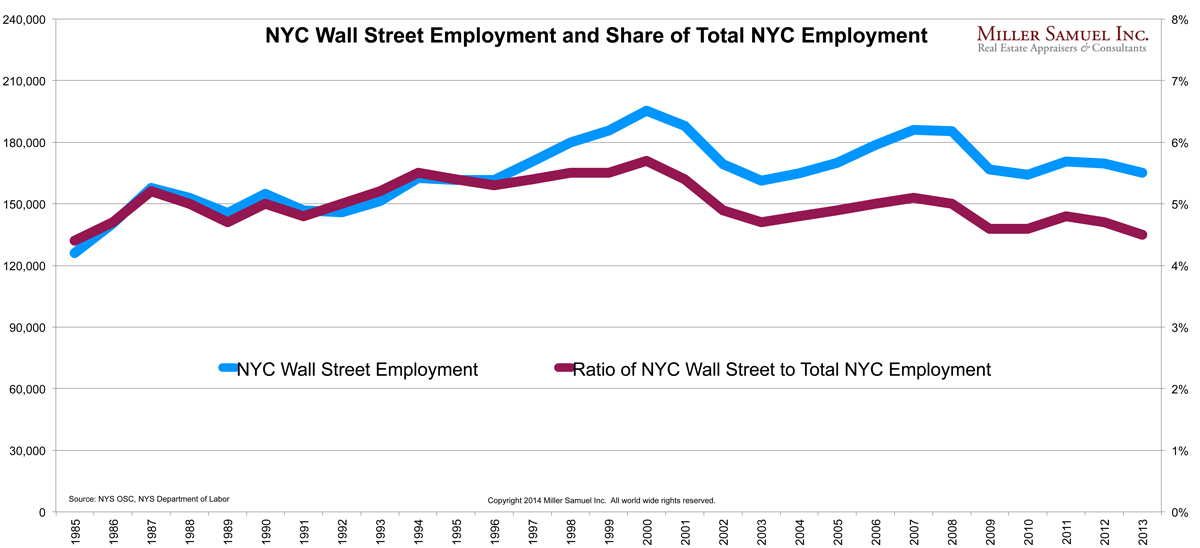

The annual release by the New York State Office of Comptroller brought upbeat news to the real estate economy in NYC. Wall Street compensation has long accounted for roughly a quarter of personal income but only 5% of employment so the industry remains very important to NYC’s tax revenues. Here are some of the key points:

* The overall bonus pool and bonus per person increased 15.1%.

* The total bonus pool was

* Bonus pool is up 44% in past 2 years.

* Securities employment is down 12.6% from before the 2008 market crash.

* Wall Street accounts for 8.5% of NYC tax revenue and 16% of NYS tax revenue

* Part of the rise was due to payouts of deferred compensation from prior years.

Here are a few charts that layout the bonus trends in NYC. Wall Street is a key economic driver of NYC and therefore important to the health of the NYC housing market.

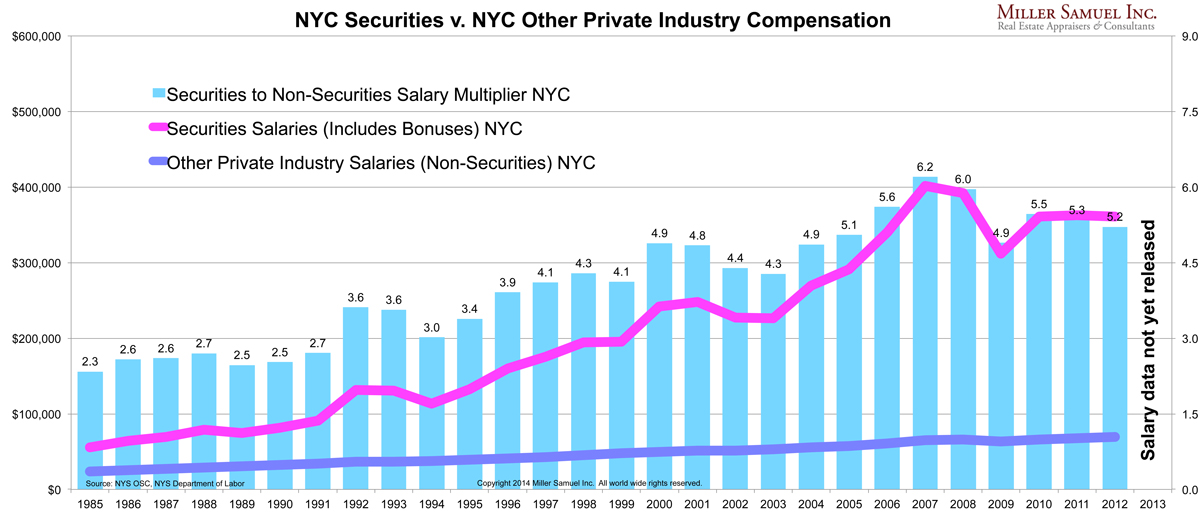

Wall Street compensation is 5x that of mere mortals (other private employment compensation) and that ratio has stabilized after a modest correction following the 2008 stock market crash.

Wall Street bonuses rose steadily as a portion of total compensation but after the 2008 stock market correction and financial reform, the market share fell – but not as much as perceived.

[click to expand]

[click to expand]

Wall Street employment has fallen since 2008, but not nearly as much as expected. The market share of Wall Street NYC employment has slipped as a result.

[click to expand]

[click to expand]