Bob Hagerty’s quarterly survey on the state of the housing market explores some positive news amid all the negativity. The article titled The Brighter Side of Housing brought to mind the Monty Python song in the Life of Brian movie: Always look on the bright side of life.. I can’t get that darn whistling out of my head.

>Economists at Goldman Sachs say home prices are likely to level off by late 2009. They also point to improving affordability. Goldman’s chief U.S. economist, Jan Hatzius, says the share of a typical family’s income needed to pay mortgage payments on a median-priced home averaged about 17.5% from 1993 to 2003, before jumping to 26% in 2006. The figure now has fallen to 20% and is likely to keep declining as home prices fall.

I met Jan last year at a meeting and he pumps out some impressive research so this is something to look at.

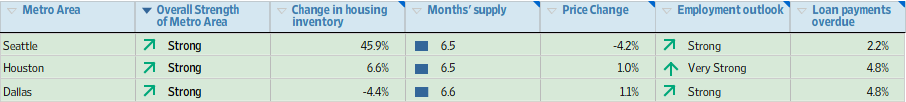

The WSJ put together a very cool interactive table that sorts by metro area strength, change in inventory, month’s supply, price change and loan payments overdue.

I was surprised by the strength rating of Seattle given the spike in inventory over the past year as well as weak rating for New York given its low inventory levels.

One Comment

Comments are closed.

I read another article saying some postiive things with their index. IAS360 house price index?