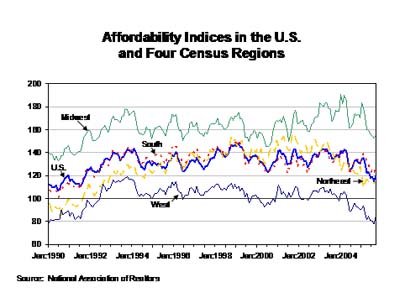

Over the past 18 months, affordability has [dropped despite increases in income growth and low mortgage rates [FNMA].](http://www.fanniemae.com/media/berson/weekly/index.jhtml) “The National Association of Realtors’ (NAR) housing affordability index is at its lowest level since 1991 (and, using our own calculations, affordability has fallen to the lowest levels since the early-to-mid 1980s in some high cost areas). The NAR first-time homebuyer index is at its lowest level since 1985.”

Fannie Mae’s economists note the cause for the drop in affordability is:

* The rise in home prices.

* Increases in investor/second home purchases

* Looser overall underwriting

* Popularity of low initial-payment ARM mortgages

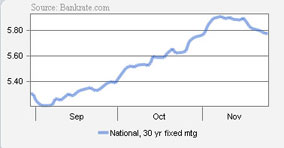

Well, affordability is weakening, not because of the fact that mortgage rates are low, but because mortgage rates have been rising since mid-summer until a few weeks ago. Every notch upward that mortgage rates increase, knocks someone out who was on the fence (sorry, I wanted to say “who were on the bubble” like the Indy 500 qualifiers but that would be too dramatic.)

Affordability is basically a mortgage payment and how it relates to personal income. If income is stable, then affordability is all about the payment. As the payment rises due to mortgage rates, then people get knocked out for lack of qualifying. Its as simple as that.

As more and more people fall out of the market because they don’t qualify for their mortgage, there is less pressure on prices. That would be the expectation. However, in much of November, mortgage rates actually fell bringing more people back into the market as affordability increased.

One Comment

Comments are closed.

If there is one factor that concerns me about the real estate market, it’s the issue of affordability. A question I love to ask homeowners is “could you afford to buy your home at today’s prices?” More often people are saying no, and buyers seem to have done the same recently. In our market north of New York City, where over 90% of the market participates in the multiple listing service we have hard data to draw our conclusions from. The fact is, the number of new and expired listings have increased, as are days on market, while the number of properties going into contract has sharply declined. The optimistic sales agents/brokers are calling it “seasonal”, but I’ve not seen this look on their faces since the early 90’s.