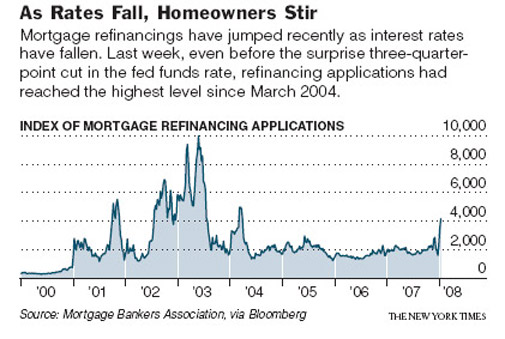

According to the Mortgage Bankers Association, there has been a surge in refi applications this week has resulted in a refi-boom. Mortgages rates are falling.

Its been a week since the Fed’s rate cut and we are already seeing reports that the market is stirring in some locations…although this strikes me as basically anecdotal-based reporting, no?

> “Blood in the streets!” Ms. Gable said cheerfully. “That’s the best time to buy.”

>This week, the average 30-year fixed rate was 5.48 percent; the rate was approaching 7 percent as recently as last summer.

>…At what point will buyers be compelled to act, thinking they are getting a price they can live with and a rate they do not want to miss?

>One indisputable effect of the Fed action is a rise in refinancing applications, continuing a trend that started late last year.

Talking head hoopla…

It’s hard to understand the world clearly without watching The Daily Show. Here’s the recent appearance by CNN real estate show host Gerri Willis with Jon Stewart on Comedy Central. The whole clip is entertaining, but if you don’t have time, fast forward to the 5 minute mark to catch the talking head chatter (Barbara Corcoran?). Wow.

2 Comments

Comments are closed.

“We have a high unemployment rate in this country …”

HUH???????????????????????????????????????

I guess that’s why she’s a talking head and not actually in financial services.

Since the Fed has cut has started cutting rates, I have seen an increase in people looking to buy homes in the under $200,000 range. It is now coming to the point where it is getting to a leveling off point between buying and renting, when all fctors are added in i.e. tax savings, home ownership and appreciation.

Larry Lang e-Pro Realtor

South Florida rentals and homes