S&P just released their “Variations In U.S. Shadow

Inventories Could Spell Home Price

Declines In Some Areas, Stabilization

In Others” report which looked at shadow inventory and its impact on the regional pricing.

source: S&P

source: S&P

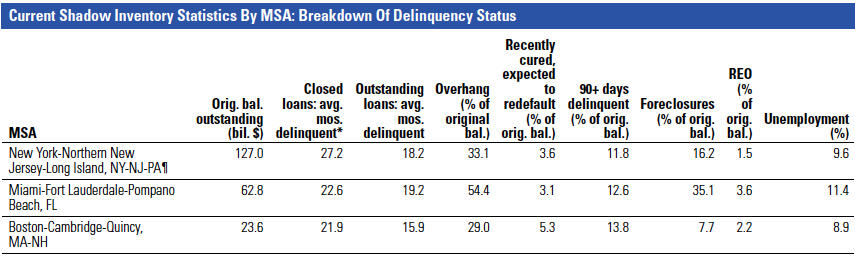

>The volume of troubled residential properties has been growing in nearly every U.S. state since 2005, and borrowers

nationwide are now defaulting on their mortgages faster than existing defaults are being resolved through

liquidation, according to Standard & Poor’s Ratings Services. These trends have given rise to a large “shadow

inventory” of distressed properties—which we define as outstanding properties that are (or were recently) 90 days or

more delinquent on mortgage payments, in foreclosure, or real estate owned (REO)—that haven’t yet hit the market.

source: S&P

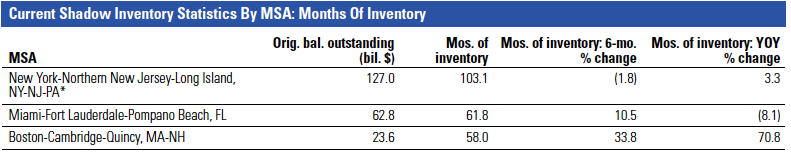

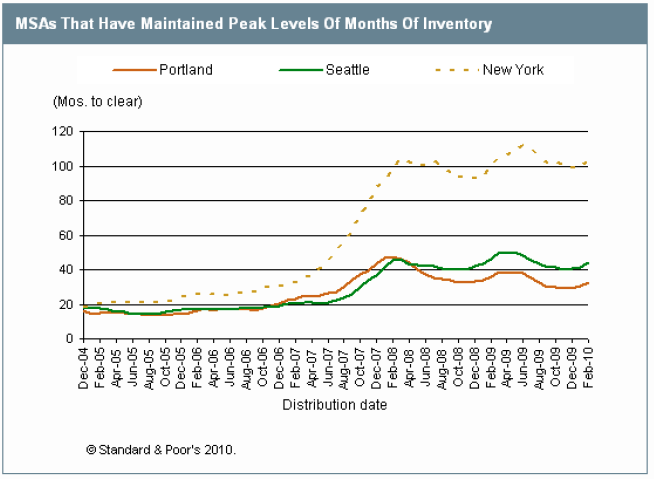

The New York City metro area had the highest level of shadow inventory at 103.1 months, followed by Miami with 61.8 months and Boston with 58 months. The report suggests Miami is improving, but relative to what? Miami still shows more than 5 years of shadow.

source: S&P

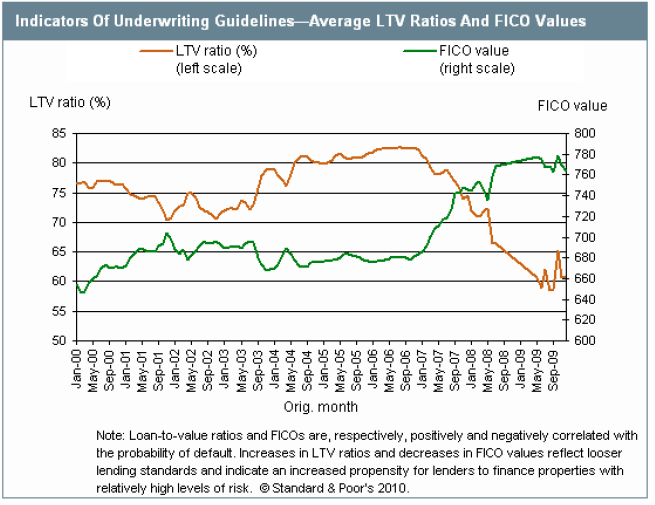

>The fallout from the recent mortgage crisis has reduced financing for borrowers as lenders began to enforce stricter

underwriting standards. Lenders have generally become more selective about their borrowers, providing

fewer would-be homebuyers with loans.

download report [my link – S&P report link being fixed at time of this post]

6 Comments

Comments are closed.

Probably a dumb comment, but does the difference in shadow inventory make a difference?

I would assume condos that can convert to rental is not quite as bad as a foreclosed house. I understand you can rent the house, but the impact on your neighborhood seems to be greater.

I just wonder if the shadow inventory issue is a little overstated in NYC.

I would guess the shadow inventory is in the outlying NYC metro area not nyc itself.

Note New York region has one of the lowest unemployment rates. These figures are distorted because the sales volume in other regions, includes large numbers of foreclosure sales! In New York, a judicial foreclosure state with a long lag time, these foreclosures have not happened in large volume yet, and because of the long lag time, may never happen in many cases.

I assume the skew is because of the foreclosure moratorium in New York delayed the excess product from being cleared – but even so – I can’t get my arms around the miami-nyc flip flop. Someone in my office reminded me about this so I thought I’d add a comment on it.

As a prospective buyer, these reports need to distinguish between Manhattan and NYC Metro Area (LI, New Jersey, etc.). The shadow inventory in Manhattan is not significant and what does exist is a) clustered in less desirable areas (Clinton, Harlem, Financial District) or b) rented or becoming a rental (hence the meaningful decline in rents over the past couple years). Manhattan supply in desirable areas is limited and properties are moving. As a buyer, I wish this wasn’t the case but it’s reality.

I’m pretty sure you’re an agent, developer or marketing consultant for a developer because I’ve been hearing this pitch a lot lately from people like yourself. In fact, I assume this was written by one of several people who I know have said this repeatedly. A buyer would NOT say what was just said here. Seriously.

I do think the results of the S&P report are highly questionable and I don’t place much faith in its reliability. However your comments are almost a panic-like marketing response to the idea that shadow is somehow isolated in former “emerging markets”.