One of the first usable analyses that outlines affordability “what-ifs” in the relationship between housing prices and mortgage rates is presented by Marc Gerstein, Director of Research at Reuters.com in [What’s The Real Cause of Housing Softness? [Seeking Alpha]](http://usmarket.seekingalpha.com/article/16542). The results are in national terms so the results probably don’t apply to your specific housing market but the logic is reasonable and helpful.

There is debate whether the housing downturn is attributable more to global events such as the Iraq War, terrorism, the mood of the American consumer and others. NAR contends that its affordability thats the primary issue. I think its a combination of both.

A few years ago, _when the planets were in alignment_, it was sunny everyday and all traffic lights were green, the real estate market moved faster than buyer-seller logic could process. Flexible lending practices accelerated the optimism blocking out awareness of external conditions. (Everyone was thinking, _I can make a lot of money in real estate_.)

Declining affordability issues didn’t take hold well into the boom cycle, actually too late, primarily through rapidly rising prices, followed by rising mortgage rates.

Now what matters is affordability to bring buyers back into the market. Falling mortgage rates will help but in certain parts of the country, it will take a price correction to get the market back on track.

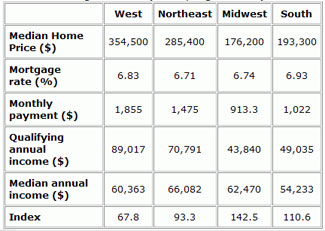

Reuters relied on the July 2006 affordability data by NAR which uses the old fashioned comparison of median sales price, median income and lending criteria for a 30-year fixed, 20% down mortgage. Admittedly this is very conservative. The resulting index using adjustable rate mortgages, would likely be too optimistic.

When broken out by region, its amazing how much affordability differs. Affordability in the midwest is nearly double that of the west. The west and northeast are the least affordable while the midwest and south are the most. (Perhaps thats why there seem to be so many more real estate blogs on the coasts).

Using [housing futures contracts offered at the Chicago Mercantile Exchange [Matrix]](http://matrix.millersamuelv2.wpenginepowered.com/?p=799), they seem to point to price declines over the next six months. They plotted the change in median sales price against various mortgage rates for the two weakest regions and came up with some interesting results. It is based on the scenario that the economy will continue to weaken, prompting mortgage rates to decline. One caveat they present is the assumption that personal income may decline as a result of the change in overall economy, which would make affordability rates less.

Northeast: If mortgage rates remain stable, prices would have to decline 10% to achieve parity between housing prices and income. If mortgage rates fall as much as they have since Memorial Day, prices would need to fall 5%.

West: If mortgage rates remain stable, prices would have to decline roughly 35% using their calculations to achieve parity between housing prices and income. If mortgage rates fall as much as they have since Memorial Day, prices would need to fall 30%. Not a great scenario.

So when speaking about the real estate market, its important to make the distinction as to what markets you are referring to (or what planet you are on since they are not in alignment anymore).

One Comment

Comments are closed.

It’s interesting reading everyone talk about the inpact of interest rates on the slowing real estate market. “Rates when up .24356, that’s why real estate is slowing” etc.

That is nothing!

I live in Florida. I paid $3500 for my home owners policy last year. I thought that was too high. I just got my renewal notice. My new premium is $12,500! That’s an increase of $700 per month!

Florida and the coastal areas of the US are in a free fall in preoperty values as it is. This new wave of insurance hikes will be a disaster for coastal property values!