Guest Columnist:

Todd Huttunen

Todd Huttunen began appraising more than 20 years ago with a few years off in between to pursue a career in cabinet making. He relegated that to hobby status and is currently an appraiser in an assessor’s office. His best friend dubbed him The Hall Monitor because of his rigidity and respect for rules. He offers Matrix readers tongue-in-groove insight on appraisal and housing issues. View his earlier handiwork on my first blog, Soapbox

Jonathan Miller

Seasonality Should be Considered in Comp Selection

April 26, 2010

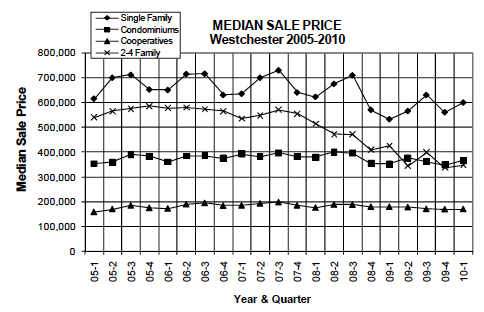

The Westchester numbers for the first quarter just came out today. Even with the turbulence we’ve seen in the last couple of years, there remains a consistent trend in the median selling prices as relates to “seasonality”.

Not unlike Metro-North or Hamptons rentals, there is a “peak” and an “off peak”.

Whether the overall market is trending up or down, houses that close in the second or third quarters sell for considerably more than those that close in quarters four or one.

Appraisals done “in season” (assuming 60 days from contract to closing, these would be valuation dates in the six months between February 1 and July 31) should rely, if possible, on sales that closed in the second and third quarters, if not from the year of the appraisal then on the prior year. Conversely, appraisals made between August 1 and January 31, or “off season”, should focus on sales from quarters four and one.

Adjustments are required for the difference in market conditions between “in season” and “off season” for single family houses in the New York metropolitan area. What those adjustments should be can be fairly easily calculated by looking at the historical data for median prices. Remarkably, in Westchester at least, the differences are pretty consistent either in upward of downward trending markets.

Check out that serpentine line on the Median Price chart – just for fun, print it out and draw a line connecting only quarters two and three to each other over the years. Then do the same to quarters four and one and watch how quickly that serpentine line straightens out into two lines with much more of a consistent trend to them.

I really don’t understand why appraisers are so stuck on this idea that only sales taking place within six months of valuation date should be used. Six month old sales can be the most misleading ones of all, insofar as market conditions are concerned.

p.s. I know I addressed this issue in a prior post but it bears repeating since it seems almost no one is paying any attention.