On Friday morning, I was one of five expert witnesses (and the only as an appraiser) to testify on the topic of appraisal bias in front of the Appraisal Subcommittee (ASC). The witnesses waited together in the green room, plus additional The Appraisal Foundation (TAF) staff. We had a delightful conversation – everyone was very friendly and a pleasure to be with, given the adversarial nature of our looming testimony.

I’ve spoken many hundreds of times on national television but never on C-SPAN, so participating in this event was a bucket list check-off for me. The FHFA auditorium and facilities were impressive – the organization of the event was first class and ran very smoothly (way to go, Julie!).

During the first hour of testimony, our fourth grandchild was born. My wife was in the audience and stepped out of the hearing (the nerve!) to take the call from my oldest son on the news of our new granddaughter.

The Appraisal Subcommittee (ASC) held a second hearing on challenges facing the appraisal industry, including barriers to entering the profession and racial bias in home appraisals. The panel’s first hearing on such topics occurred in January. The ASC is an interagency committee under the Federal Financial Institutions Examination Council and oversees real estate appraisal regulations. The Federal Housing Finance Agency hosted the event at its headquarters in Washington, DC.

It’s a three-hour hearing, but if you are connected to the appraisal industry in any way, I encourage you to listen. You can hear my opening statement at about the 26-minute mark. The text on the C-SPAN website was generated from unedited closed captions. Here was my formal statement, but since the timing was strictly limited to 5 minutes, I read this abbreviated version, which in hindsight, was better and more to the point.

Federal Housing Finance Agency (@FHFA) hearing on Appraisal Industry Issues – LIVE at 10 am ET on C-SPAN https://t.co/uyAqNgs1tk

— CSPAN (@cspan) May 19, 2023,

Afterwards…

Three regulators from the ASC came to me from the stage immediately afterward and said I was the best dressed in the room, and they loved my tie. I wasn’t expecting that. Ha. All were very nice. My wife and I immediately shared pictures of our new granddaughter.

Thoughts…

Morgan Williams, General Counsel, National Fair Housing Alliance – He was a compelling witness – he drove home that he wanted access to anonymized loan-level data to determine the potential valuation bias.

Angela G. Jemmott, Bureau Chief, California Bureau of Real Estate Appraisers, Member of the Association of Appraiser Regulatory Officials. She was a powerhouse of testimony, advocating practicum solutions in addition to PAREA.

Michelle Czekalski Bradley, Certified General Appraiser, Chair of the Appraisal Standards Board (ASB) of TAF, was earnest and towed the Dave Bunton narrative. When the CFPB head went after her for the conflict of interest of her position, she named me by name (an unforced error) and said there was no conflict. She may believe that with all her heart, but most of her peers in the industry think otherwise. Her husband is a senior official at McKissock, the largest provider of online appraisal courses, and they have a financial arrangement with TAF on USPAP courses – and Michelle heads the board that makes changes to USPAP. This is another example of the stunning lack of oversight for this not-for-profit (TAF) that modifies USPAP that becomes embedded into laws in the 50 states and five territories. I’m sure she means well and, in her mind, is giving back to the industry, but she is remarkably oblivious to the optics of her position. I believe Dave Bunton hand-selected her for her ability to follow orders. TAF is a monarchy, nothing less.

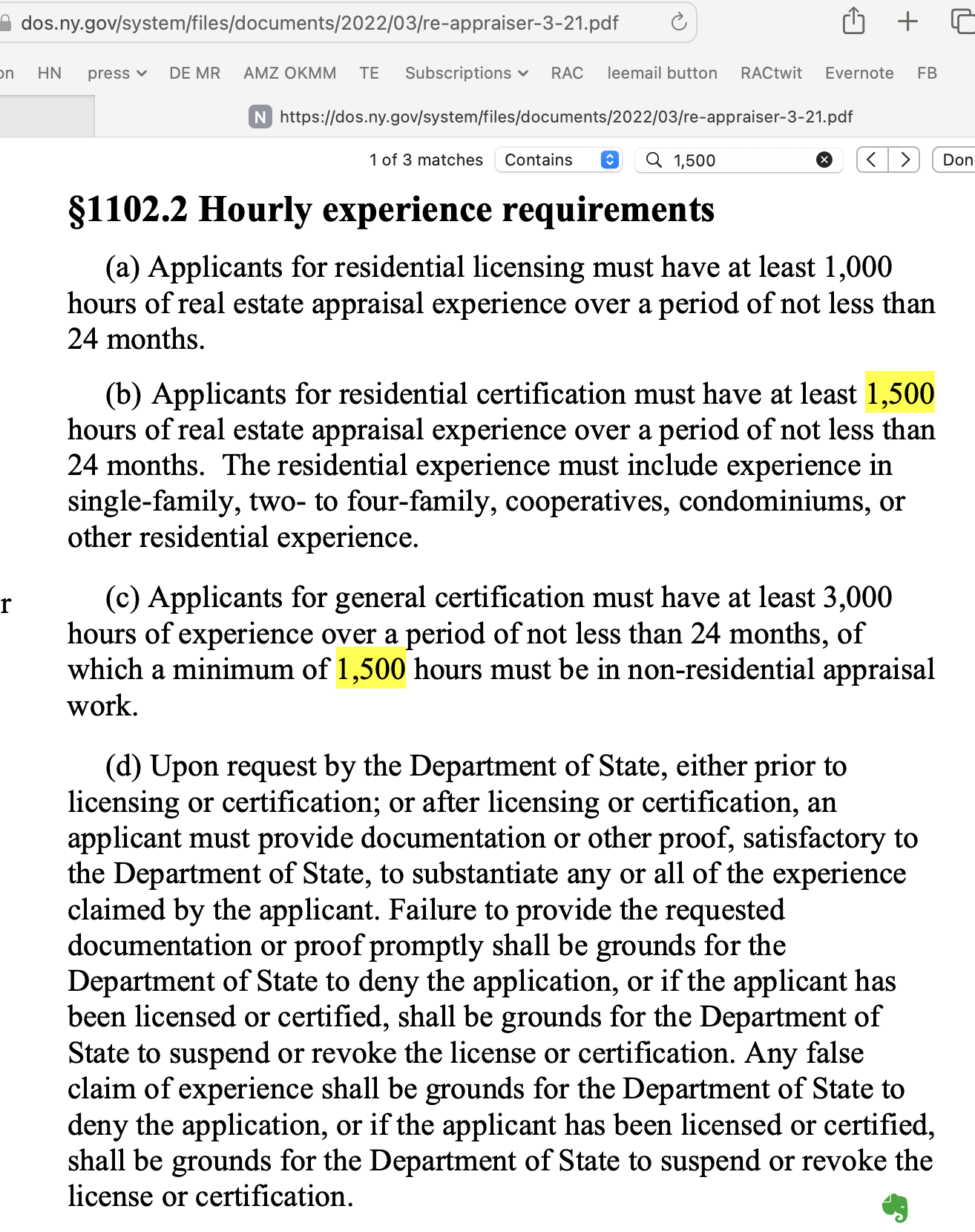

Brad Swinney, Chief Appraiser, Farm Credit Bank of Texas, Chair of the Appraiser Qualifications Board (AQB), had a hard time presenting and defending PAREA. He, like Michelle, was hand selected by Dave Bunton after the prior AQB chair was removed immediately because he wanted to explore the stunning lack of diversity in the appraisal profession. (We’re 98% white and dead last (400 of 400) as tracked by the BLS). So it follows that if the prior chair was removed immediately after trying to dig into the appraisal industry’s lack of diversity, then it’s just a hop, skip, and jump to assume that Brad was brought in to follow Dave Bunton’s position of staying away from the topic. Brad mentioned several times that “someone” (me) was saying 1,500 hours of experience were required, yet he stated only 1,000 hours were required for residential certification experience. As the AQB chair, he was uninformed. I was referring to the New York State requirement for 1,500 hours as a New York City appraiser, as noted on the New York State website.

I’m glad we’ve cleared that up.

TAF’s representatives (Michelle & Brad) were under siege by the ASC board and did not do well under fire. They found themselves wiggling to defend the indefensible even though they were hand-picked by Dave Bunton for their ability to toe the party line. Both tried hard to frame themselves in a silo – Michelle – when it came to how board members were selected and Brad – how they had no responsibility for how much PAREA would cost appraisers. To be clear, TAF had always pushed back hard on PAREA until Dave realized that it could be used to divert attention from, and possibly have a positive influence, on our industry’s stunning lack of diversity.

When I was highly critical of the two-year cycle in my testimony and how TAF goes back and forth on rules that confuse everyone, Michelle brought up the current four-year run of USPAP without changes and how on January 1st, there will not be an expiration date. The problem with framing it that way was that TAF claimed USPAP was frozen for four years because of COVID. Dave saw the pressure coming for change and used COVID as an excuse, yet the reality was that Zoom became ubiquitous, and there was no reason to stop the cycle other than to use COVID to save face. Dave recently realized that because states required USPAP 7-hour update courses every two years, they were still going to benefit from a revenue flow from the classes and could still avoid grant money from the ASC so they wouldn’t have any “strings” attached to their actions. Dave can still fly all over the world on boondoggles to valuation conferences, dining on steak and fine wine without scrutiny. I brought up in my testimony that only about 15 minutes of each 7-hour update class contained new information.

To be clear, only one person of color has been on a technical board (ASB + AQB) in the 3+ decade history of The Appraisal Foundation, which has been led by the same person the entire time. And that one person, despite being highly qualified, was only accepted on the board because of significant outside pressure from myself and a handful of others. Proof of this is that no more persons of color were invited to any of their boards in the ensuing three years.

For many TAF board members, this is just a resume builder. They won’t do anything to forward progress in the industry because Dave Bunton and his sycophants will work hard to prevent it like they just did on the AQB. But some people will work as insiders to make a difference as long as Dave and Kelly don’t know who they are.

This TAF “byzantine and weird” corporate bureaucracy is an unfair burden to everyday working appraisers and is destroying the public trust. I hope last Friday’s testimony helped confirm a few reasons why there is no diversity in the industry, and it will enable the ASC to push for accountability and change at TAF.